Get Ca Cdtfa-146-res (formerly Boe-146-res) 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the CA CDTFA-146-RES (Formerly BOE-146-RES) online

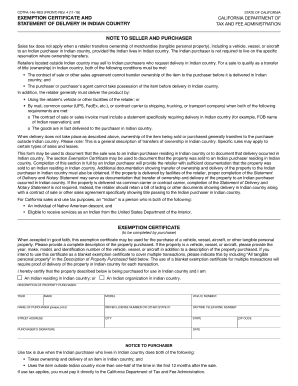

Filling out the CA CDTFA-146-RES form online can simplify the process of documenting sales transactions involving Indian purchasers in California. This guide provides clear and sequential instructions to ensure users complete the form accurately and effectively.

Follow the steps to complete the CA CDTFA-146-RES form online.

- Click ‘Get Form’ button to access the CA CDTFA-146-RES form and open it in the editor.

- Begin by reading the instructions provided with the form, which outline the necessary conditions for tax exemption when transferring ownership to an Indian purchaser in Indian country.

- Complete the Exemption Certificate section. Provide a full description of the property purchased, including year, make, model, and identification number if applicable. If this form is being used as a blanket exemption, indicate 'All tangible personal property' in the Description of Property Purchased field.

- In the Purchaser’s section, print the name of the person making the purchase, along with their driver license number or state ID, daytime telephone number, street address, city, state, and ZIP code.

- The purchaser must sign and date the form to certify that the information is accurate and that they are either an Indian residing in Indian country or an Indian organization in Indian country.

- Next, navigate to the Statement of Delivery section. Enter the type of merchandise along with the year, make, model, and VIN/license number if applicable.

- Provide the name of the reservation, the address, including street, city, and ZIP code, where the delivery occurred, as well as the date of delivery.

- The seller must complete their section by providing their name, seller’s permit number, daytime telephone number, and address.

- Have the seller sign and date the form, certifying that the property was delivered to the purchaser in Indian country.

- If applicable, complete the Notary Statement section to verify the identity of the individual signing the document. This is typically done by a California notary public or authorized tribal representative.

- Once all sections are completed, review the form for accuracy. Users can then save their changes, download the completed form, print it for their records, or share it as necessary.

Start filling out the CA CDTFA-146-RES form online today to streamline your documentation process.

Get form

Related links form

In California, certain organizations and types of sales qualify for sales tax exemption, such as non-profit organizations, government entities, and specific items like food and prescription drugs. To apply for exemption, you'll need to complete the appropriate paperwork, often including forms like the CA CDTFA-146-RES (Formerly BOE-146-RES). Resources from USLegalForms can assist you in understanding the requirements and processes involved.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.