Loading

Get Ct Drs Reg-1 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS REG-1 online

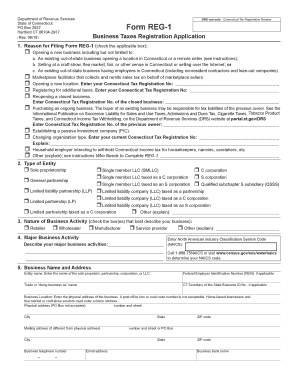

Filling out the CT DRS REG-1 form online is an essential step for individuals and businesses seeking to register for various taxes in Connecticut. This comprehensive guide will walk you through each section of the form, ensuring you provide accurate information to facilitate a smooth registration process.

Follow the steps to fill out the CT DRS REG-1 form online.

- Click 'Get Form' button to download the CT DRS REG-1 document and open it for editing in your preferred tool.

- Begin by identifying the reason for filing the form. Carefully check the box that corresponds to your situation, whether opening a new business, a marketplace facilitator, or any other applicable scenario.

- Select the type of entity by checking the appropriate box. Your options include sole proprietorship, corporation, limited liability company (LLC), and more. Ensure you select the correct entity type as it affects your tax considerations.

- Indicate the nature of your business activity by checking all applicable boxes, such as retailer, wholesaler, manufacturer, or service provider.

- Provide your major business activity by entering the North American Industry Classification System (NAICS) code and describing your activities briefly.

- Fill in your business name and address, including the physical address, which should not be a post office box. Ensure that the details match any relevant business registration documents.

- List all owners, partners, corporate officers, or LLC members. You can attach additional sheets if necessary, ensuring all personal information is complete and accurate.

- Address the income tax withholding section, answering the questions related to your intentions as an employer and filing dates as necessary.

- Complete the sales and use taxes section by indicating your sales activities in Connecticut. Provide the start date for your selling activities if applicable.

- If applicable, respond to questions about the prepaid wireless E 9-1-1 fee, including your start date for selling these services.

- Fill out details regarding any corporation business tax or unrelated business income tax situations, and provide the necessary dates and supporting information.

- Explain any business use tax liabilities you may have if enrolling for sales and use taxes, ensuring all declarations are completed.

- Enter the total registration fee amount accurately based on your registration needs and ensure the payment is included with the form if submitting by mail.

- Finally, sign and date the declaration section to verify the truthfulness of your application, and keep a copy for your records.

- Upon completing the form, save your changes, and take the necessary steps to download, print, or electronically share the completed REG-1 form as needed.

Ready to begin? Complete your CT DRS REG-1 form online to ensure your business is properly registered.

Related links form

Yes, if you operate a business in Connecticut, you typically need to register it with the state. This registration is crucial for tax reporting and compliance purposes. Utilizing resources like the CT DRS REG-1 will guide you through the necessary steps to ensure your business is properly registered.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.