Get Mi Dot Mi-1040cr-2 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT MI-1040CR-2 online

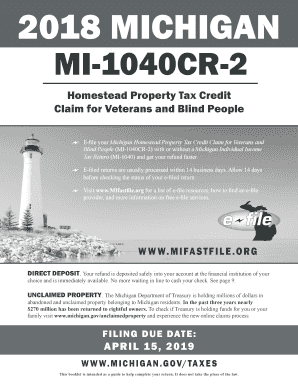

The MI DoT MI-1040CR-2 is a critical form for individuals seeking a homestead property tax credit in Michigan, specifically for veterans and blind people. This guide provides clear instructions to help users navigate the process of filling out this form online effectively and accurately.

Follow the steps to complete the MI DoT MI-1040CR-2 online.

- Press the ‘Get Form’ button to acquire the form and open it in the online editor.

- Enter your name(s), address, and full nine-digit Social Security number(s). If filing jointly, include both names.

- Indicate your filing status by checking the appropriate box: single, married filing jointly, or married filing separately.

- Check your residency status for 2018 by marking non-resident or part-year resident as applicable, and enter any relevant dates.

- Indicate if you are blind, a veteran, or the spouse of a qualified individual, including disability percentage if relevant.

- Enter the taxable value allowance from Table 2 based on your status and collect any necessary documentation.

- Provide the taxable value of your homestead, ensuring it does not exceed $135,000; otherwise, you are ineligible.

- List property taxes levied on your home for 2018 and calculate the percent of tax relief by dividing the taxable value allowance by the taxable value.

- Multiply the property taxes by the percent of tax relief and record this credit amount, ensuring it does not exceed the specified maximum.

- Compile total household resources by reporting all applicable income, and determine adjustments as needed.

- If applicable, complete the FIP/MDHHS Benefits Worksheet to determine any prorated credits based on your total resources.

- Review the completed sections to ensure accuracy, particularly your Social Security numbers, names, and financial figures.

- Finalize your document by saving it. You can choose to download, print, or share your completed form with relevant parties.

Complete the MI DoT MI-1040CR-2 online now to ensure you receive your homestead property tax credit.

Get form

You can obtain your Michigan property tax statement through your local assessor’s office, either in person or online. Many counties provide access to tax statements through their official websites, where you can look up property information by address or parcel number. Ensuring you have your statements is crucial for completing your MI DoT MI-1040CR-2 form accurately.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.