Loading

Get Mi Mi-w4 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MI-W4 online

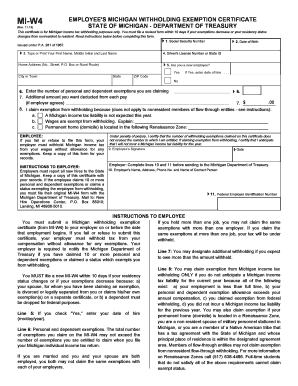

The MI MI-W4 is the Michigan withholding exemption certificate, essential for determining the amount of state income tax withheld from your wages. This guide provides clear instructions for filling out the form online, ensuring that you understand each component and can complete it accurately.

Follow the steps to successfully complete the MI MI-W4 online.

- Press the ‘Get Form’ button to access the MI MI-W4 form and open it in your document editor.

- Enter your Social Security Number in the designated field. Ensure accuracy as this number is crucial for identification purposes.

- Provide your date of birth in the specified format. This information helps confirm your identity.

- Type or print your first name, middle initial, and last name clearly in the designated space.

- Input your driver's license number or state ID, if applicable.

- Fill in your home address, including street number, street name, P.O. Box, or rural route.

- Indicate your city or town, followed by the state and ZIP code.

- Answer whether you are a new employee by selecting 'Yes' or 'No.' If 'Yes,' enter your date of hire in the provided format.

- Specify the number of personal and dependent exemptions you are claiming in the appropriate field.

- If you wish to deduct an additional amount from each pay, enter that amount in the field provided.

- In section 8, indicate your reason for claiming exemption from withholding if applicable, ensuring compliance with the listed criteria.

- Review your entries carefully for accuracy.

- Sign and date the form at the bottom to certify your claims are truthful.

- Once all information is complete, save your changes, download the completed form, or print it for your records.

Complete your MI MI-W4 form online today to ensure accurate tax withholding.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You may be exempt from Michigan withholding if you had no tax liability in the previous year and anticipate the same for the current year. Additionally, certain groups, like students or those earning below a specific income level, might qualify for exemption. It's always best to review your situation or consult with a tax professional to confirm your exemption status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.