Loading

Get Mo Dor 4572 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR 4572 online

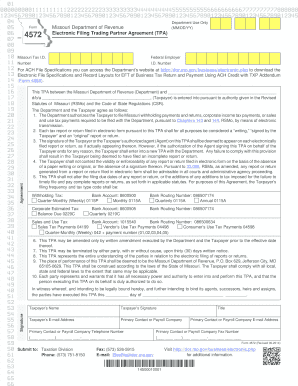

The Missouri Department of Revenue 4572 form, also known as the Electronic Filing Trading Partner Agreement, is essential for individuals and businesses to authorize electronic tax filings. This guide will provide user-friendly instructions on completing the form online effectively.

Follow the steps to complete the form seamlessly.

- Locate the 'Get Form' button to initiate the process of accessing the MO DoR 4572 form. This will allow you to open the document in your preferred online editor.

- Provide your Missouri Tax ID number in the designated field, ensuring accuracy as this information is crucial for your filing.

- Enter your Federal Employer Identification Number (EIN) in the corresponding section, confirming that the details match your official records.

- Fill in the I.D. number, which is necessary for the Missouri Department of Revenue to track your filings.

- Review the agreement terms highlighted in the form. By checking this section, you acknowledge your understanding and acceptance of the filing requirements and responsibilities.

- Fill out the taxpayer name and doing business as (d/b/a) name in the spaces provided. This identifies who is authorized to file under the agreement.

- Indicate your bank account details, including the bank account number and routing number, for ACH transactions related to tax payments.

- Note the frequency of your tax filings in the relevant sections, which helps the Department maintain proper records of your filing schedule.

- Provide the contact details for the primary contact person or payroll company, including their name, email address, phone number, and fax number.

- Finally, review all the information you have entered for accuracy. Once confirmed, you can save your changes, download, print, or share the completed form as needed.

Complete your documents online today for a smooth filing experience.

Related links form

The 1040EZ form is generally considered one of the simplest options for filing your taxes, especially for those with straightforward financial situations. It requires less information than other forms, making it less complicated. However, some may still struggle with understanding specific requirements. For easier navigation through this form, resources tied to MO DoR 4572 can be invaluable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.