Get Ut Ustc Offer In Compromise Booklet 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC Offer in Compromise Booklet online

Completing the UT USTC Offer in Compromise Booklet online can seem challenging, but with clear guidance, you can navigate the process smoothly. This guide will walk you through each step to ensure your submission is accurate and complete.

Follow the steps to fill out the UT USTC Offer in Compromise Booklet online.

- Press the ‘Get Form’ button to acquire the UT USTC Offer in Compromise Booklet and open it in your preferred online editor.

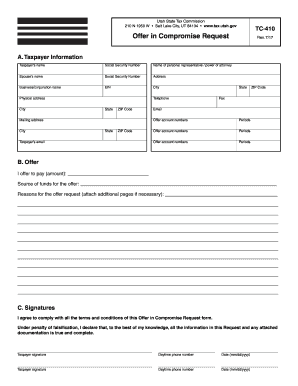

- Fill out the taxpayer information section, including taxpayer’s name, Social Security number, address, and contact details. Be thorough to prevent any delays in processing.

- Complete the offer section by stating the amount you offer to pay and providing the source of funds. Clearly explain your reasons for the offer request, attaching additional pages if necessary.

- Proceed to the signatures section. Ensure that you and any authorized person sign and date the form, providing daytime phone numbers for contact.

- Review the entire form to confirm that all required fields are completed accurately. Double-check for any missing information.

- Once satisfied with your entries, you can save your changes, download a copy for your records, or print the completed form as needed.

- Finally, submit your UT USTC Offer in Compromise Booklet as instructed, ensuring to clear your form for privacy after submission.

Start filling out your UT USTC Offer in Compromise Booklet online today to take the first step toward resolving your tax liabilities.

The processing time for an Offer in Compromise can take anywhere from six months to over a year, depending on your circumstances and the IRS workload. It’s vital to monitor your application status and respond promptly to any IRS requests for additional information. Exploring the UT USTC Offer in Compromise Booklet can provide tips to expedite the process as efficiently as possible.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.