Loading

Get Ak Dor Cost Forecast Instructions 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK DOR Cost Forecast Instructions online

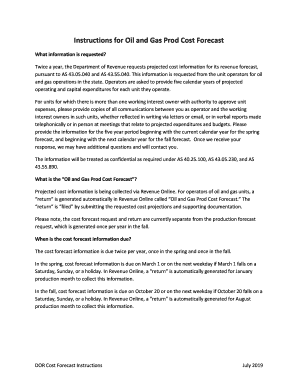

The AK DOR Cost Forecast Instructions provide a structured approach for users to submit their projected cost information to the Department of Revenue. This guide will walk you through the essential steps to accurately complete the form online.

Follow the steps to successfully complete the Cost Forecast Instructions.

- Press the ‘Get Form’ button to retrieve the form and open it in your online document editor. This will enable you to start entering the required information.

- Navigate to the appropriate account in the online system and select the ‘O&G Prod Mth’ account. Within the ‘Returns’ tab, locate and select the ‘Oil and Gas Prod Cost Forecast’ return.

- Fill out the taxpayer information section. Enter the name and contact details of the person designated to receive inquiries regarding the cost forecast information. Company name, ID, and address should automatically populate.

- Input projected operating expenditures for each unit you manage. Click ‘Add an operating unit’ and select the relevant region and unit name. If the unit does not appear automatically, enter it under ‘Non-Unitized Production’ in the appropriate geographic area (North Slope, Cook Inlet, or Middle Earth). Provide projected operating expenditures in whole dollars, excluding inflation.

- Next, enter projected capital expenditures for each unit. Again, select ‘Add an operating unit’ to choose the region and unit. For non-automatically populated units, use the ‘Non-Unitized Production’ option. Input these expenditures in whole dollars and real terms, similar to the operating expenditures.

- Upload supporting documentation as attachments if applicable. For units with multiple interested owners, provide copies of all communications regarding expenses and budgets, whether written or verbal.

- Before finalizing your submission, verify all entered information for accuracy. Once confirmed, click ‘Submit’ and electronically sign the submission with your Revenue Online password.

- If additional information or attachments are needed after submission, select the ‘Amend a return’ option from your Oil and Gas production tax account.

Complete your documents online today for a smoother submission experience.

Related links form

You must attach a letter of explanation from your employer. If you are a nonresident and your only income in Illinois is from one or more partnerships, S corporations, or trusts that withheld enough Illinois Income Tax to pay your liability, you are not required to file a Form IL-1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.