Loading

Get Ma St-7r 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA ST-7R online

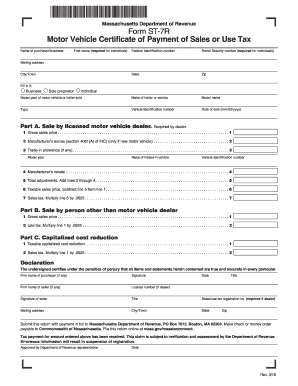

The MA ST-7R is a crucial document for individuals and businesses to certify the payment of sales or use tax for motor vehicles in Massachusetts. This guide provides clear, step-by-step instructions on how to fill out the form online effectively.

Follow the steps to complete the MA ST-7R online.

- Click the ‘Get Form’ button to access the MA ST-7R. This will allow you to view and edit the form in the designated online format.

- Fill in the purchaser's or business's name accurately. This section identifies who is responsible for the tax payment.

- Enter the first name and, if applicable, last name of the individual making the purchase. This is mandatory for individual purchasers.

- Provide the federal identification number if applicable. Individual purchasers need to include their Social Security number.

- Complete the state and zip code fields to specify the location of the purchaser.

- Specify the model year, make, and model name of the motor vehicle or trailer being purchased.

- Enter the Vehicle Identification Number (VIN) of the vehicle. This is essential for identification purposes.

- Indicate the date of sale in the format mm/dd/yyyy.

- Fill out the mailing address, including city or town. Include details about whether the purchaser is a business, sole proprietor, or individual.

- In Part A, if sold by a licensed motor vehicle dealer, complete the specified fields regarding sales price, manufacturer’s excise, trade-in allowance, and total adjustments.

- If applicable, in Part B, provide details for sales by individuals other than dealers, including gross sales price and use tax.

- Complete Part C if there are any capitalized cost reductions, detailing the taxable capitalized cost reduction and corresponding sales tax.

- In the declaration section, certify that all information is true and accurate. Include necessary signatures, dates, and titles from both the purchaser and seller if applicable.

- Review the completed form for accuracy. Save any changes made, and then download, print, or share the form as needed.

Complete your documents online today to ensure a smooth filing process.

When selling a car in Massachusetts, first ensure you have the title ready for transfer. You should complete and sign the title with the buyer, providing them with a bill of sale if required. Collect sales tax, since the buyer will need to report it when applying for registration. To simplify the paperwork, you may consider using UsLegalForms for clear instructions and necessary forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.