Get Tx Comptroller Ap-209 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller AP-209 online

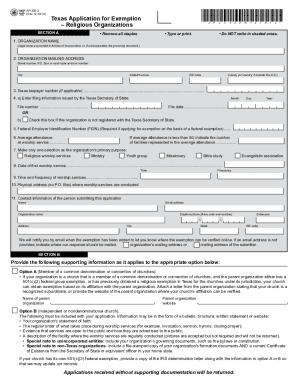

The TX Comptroller AP-209 is an essential form for nonprofit religious organizations seeking an exemption from Texas sales tax, hotel occupancy tax, and, where applicable, franchise tax. This guide provides a clear, step-by-step process to assist you in completing this form online, ensuring that you gather all necessary information accurately and efficiently.

Follow the steps to successfully complete the TX Comptroller AP-209 online.

- Press the ‘Get Form’ button to access the form and open it in your chosen digital editor.

- Begin by completing Section A, which requires your organization name and physical address where worship services are held. Ensure you type or print legibly, and do not staple the form.

- Provide the contact information of the person submitting the application, including their name, email address, daytime phone number, and mailing address if it differs from the organization’s address.

- In Section B, select the appropriate option (A or B) based on your organization’s affiliation. For Option A, attach a letter from the parent organization confirming your church’s status. For Option B, include your organization's statement of faith and additional supporting documents as outlined.

- Review the application for completeness and accuracy, ensuring all fields are filled out and supporting documentation is attached.

- Once your application is thoroughly reviewed, save your changes, download a copy for your records, and prepare to submit it. You may then choose to send your completed application by mail, fax, or email as indicated.

Start filling out your TX Comptroller AP-209 online today to submit your tax exemption application.

To qualify for an agricultural exemption in Texas, you typically need to operate on a minimum of 10 acres. However, this requirement can vary based on local appraisal district rules and specific agricultural practices as referenced in the TX Comptroller AP-209. It’s important to investigate the local regulations that govern your area. Always check with your local authorities to understand the specific requirements that may apply to your situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.