Get Tx Comptroller 50-144 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 50-144 online

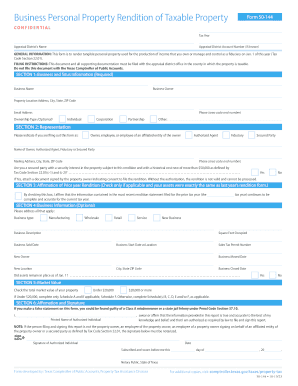

Filling out the TX Comptroller Form 50-144, also known as the Business Personal Property Rendition of Taxable Property, is essential for accurately reporting tangible personal property used for income production. This guide provides comprehensive instructions for users to effortlessly complete the form online.

Follow the steps to accurately complete the TX Comptroller Form 50-144.

- Click ‘Get Form’ button to obtain the form and access it in your online editor.

- Begin with Section 1 titled 'Business and Situs Information.' Enter your business name, owner name, property location address, email address, and optional ownership type.

- Proceed to Section 2, 'Representation.' Indicate your role (such as owner, authorized agent, or fiduciary) and provide your contact information.

- In Section 3, 'Affirmation of Prior Year Rendition,' check the box if your assets are unchanged from the previous year's rendition.

- Move to Section 4, 'Business Information.' Fill out optional business type, description, and dates related to your business, while providing your sales tax permit number if applicable.

- In Section 5, 'Market Value,' select the appropriate option indicating whether the total market value of your property is under or over $20,000.

- Complete Section 6, 'Affirmation and Signature.' Ensure that the information is accurate, and provide your printed name, signature, and date. If applicable, get the signature notarized.

- Final step: Review all entries for accuracy. Save your changes, and proceed to download, print, or share the form as necessary.

Act now to complete your TX Comptroller Form 50-144 online for timely filing!

Get form

Related links form

Filling out an exempt form typically requires you to provide essential information about your status or eligibility for exemption. Start with your personal details, such as your name and address, and then specify the nature of your exemption. Be sure to check the requirements outlined by the TX Comptroller to ensure your form is completed accurately and validated by a signature where necessary.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.