Get Pa Dced Clgs-32-6 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DCED CLGS-32-6 online

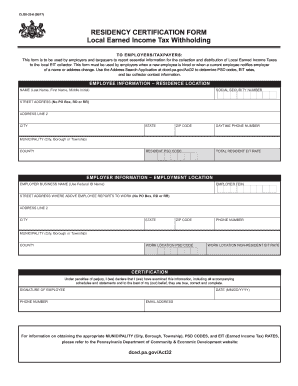

The PA DCED CLGS-32-6 form is a residency certification form used by employers and taxpayers for reporting crucial information related to Local Earned Income Taxes. This guide provides comprehensive, step-by-step instructions to help you fill out this form accurately and effectively.

Follow the steps to complete the PA DCED CLGS-32-6 form online.

- Click ‘Get Form’ button to access the form and open it in your editor.

- Begin with the Employee Information section. Fill in the employee's name using the format: Last Name, First Name, Middle Initial. Ensure that you also provide the Social Security Number, street address (avoid using PO Box, RD, or RR), city, state, and zip code.

- Continue by entering the daytime phone number, municipality (City, Borough, or Township), county, resident PSD code, and the total resident EIT rate. This information is essential for tax collection purposes.

- Move to the Employer Information section. Provide the employer's business name as registered with the Federal ID. Include the Employer FEIN, the street address where the employee reports to work (again, avoid PO Box, RD, or RR), along with city, state, and zip code.

- Next, fill in the employer's phone number, municipality (City, Borough, or Township), county, work location PSD code, and the non-resident EIT rate applicable for the work location.

- In the Certification section, the responsible person must declare that the information is true and complete. They should provide their signature, phone number, the date in MM/DD/YYYY format, and a valid email address for any further communication.

- After completing the form, review all entries for accuracy. Save any changes, and you will have the option to download, print, or share the completed form as needed.

Start filling out the PA DCED CLGS-32-6 form online to ensure compliance with local earned income tax regulations.

Whether you need to file a local tax return in Pennsylvania depends on your income level and the jurisdiction in which you work or reside. In many cases, if you earn income that is subject to local taxes, you must file a return. To ensure compliance with local laws, reviewing your specific situation and consulting resources like the PA DCED CLGS-32-6 form is advisable. This form can help clarify your filing requirements based on your circumstances.

Fill PA DCED CLGS-32-6

DCED-CLGS-06 (1-11). Act 32, signed into law in 2008, took effect January 1, 2012. Act 32, signed into law in 2008, took effect January 1, 2012. If filing a Federal or State Application for.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.