Loading

Get Ks K-99csv 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS K-99CSV online

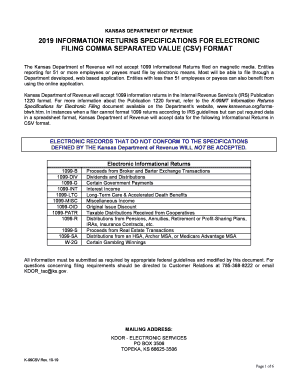

The KS K-99CSV is a vital form for reporting various informational returns electronically to the Kansas Department of Revenue. This guide will provide a clear, step-by-step approach to help users fill out the form accurately, ensuring compliance with state requirements.

Follow the steps to successfully complete the KS K-99CSV online.

- Press the ‘Get Form’ button to access the KS K-99CSV and open it in your preferred document editing tool.

- Begin with Section 1 by entering the form type, which should reflect the appropriate 1099 category such as '1099B' or '1099-DIV'. Ensure accuracy to avoid processing delays.

- In the same section, fill in the Payer’s Social Security Number or Federal Employer Identification Number, followed by their last name, first name, and any middle name or suffix, as required.

- Complete the Payer’s address by providing street address, city, state, zip code, and phone number, ensuring that all entries are within specified character limits.

- Transition to the Recipient’s details, beginning with their Social Security Number or EIN. Follow this with the recipient's last name, first name, and middle name, if applicable.

- Similarly, enter the recipient's address particulars, including street address, city, state, zip code, and phone number, ensuring to adhere to the character limitations.

- Continue filling out each relevant section based on the specific type of information return you are submitting, making sure to include all required fields as defined by the Kansas Department of Revenue.

- Once all fields are accurately completed, save your changes and prepare to submit the document electronically.

- Choose your preferred action for submission; you may download, print, or share the KS K-99CSV document as needed.

Complete your electronic filings for the KS K-99CSV online today to ensure timely and accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

There is indeed a threshold for 1099 income, generally starting at $600 for most reportable income types. It is crucial to keep accurate records of your income, which can affect your tax filing. By leveraging the KS K-99CSV, you can gain clarity on all aspects of income thresholds in Kansas.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.