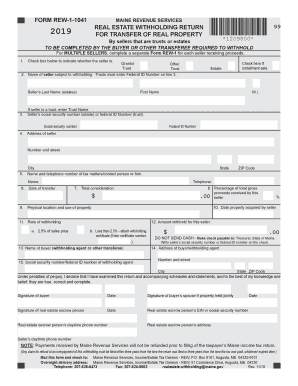

Get Me Rew-1-1041 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign ME REW-1-1041 online

How to fill out and sign ME REW-1-1041 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, the majority of Americans prefer to manage their own tax returns and additionally, to complete documentation electronically.

The US Legal Forms online platform facilitates the process of e-filing the ME REW-1-1041 swiftly and effortlessly.

Ensure that you have accurately completed and submitted the ME REW-1-1041 on time. Consider any deadlines. Providing incorrect information in your financial documents can lead to hefty penalties and complications with your annual tax filings. Utilize only reliable templates from US Legal Forms!

- Access the PDF template in the editor.

- View the highlighted fillable sections. This is where to enter your information.

- Select the option when you notice the checkboxes.

- Explore the Text tool and other robust features to manually adjust the ME REW-1-1041.

- Confirm every detail before you continue signing.

- Create your unique eSignature using a keyboard, digital camera, touchpad, mouse, or smartphone.

- Authenticate your online template and enter the date.

- Click on Done to proceed.

- Store or send the document to the recipient.

How to revise Get ME REW-1-1041 2019: personalize forms online

Place the appropriate document management features at your disposal. Fulfill Get ME REW-1-1041 2019 with our reliable tool that includes editing and eSignature capabilities.

If you wish to execute and authenticate Get ME REW-1-1041 2019 online effortlessly, then our web-based solution is your best option. We offer a comprehensive template-based library of ready-to-edit paperwork that you can modify and complete online. Additionally, there’s no need to print the document or utilize external services to make it fillable. All essential functions will be accessible for you as soon as you access the file in the editor.

Update and annotate the template

The top menu comes with options that assist you in emphasizing and obscuring text, without graphics and visual elements (lines, arrows, and checkmarks, etc.), affix your signature, initialize, date the document, and more.

- Let's explore our web-based editing features and their primary functionalities.

- The editor possesses an easy-to-use interface, so it will not take a lot of time to understand how to navigate it.

- We'll review three main areas that enable you to:

Get form

To report the Section 121 exclusion on Form 1041, indicate the exclusion amount on the appropriate line designated for deductions. Ensure you meet all eligibility criteria before applying this exclusion to avoid complications. Accurate reporting of the Section 121 exclusion directly impacts your ME REW-1-1041 tax outcome. Uslegalforms can provide specific guidance on how to navigate this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.