Loading

Get Irs 2290 Due Dates 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2290 due dates online

Understanding how to file the IRS 2290 form is essential for ensuring compliance with vehicle tax requirements. This guide will provide you with step-by-step instructions to fill out the IRS 2290 form due dates online efficiently.

Follow the steps to complete the IRS 2290 form online.

- Click ‘Get Form’ button to access the form and open it for filling.

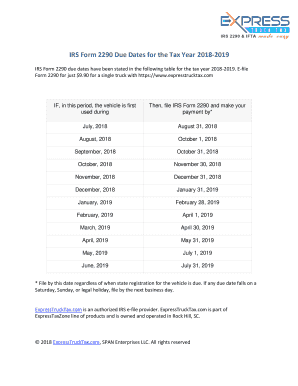

- Identify the month the vehicle was first used during the tax period. This will determine your due date for filing the form.

- Consult the due date table for the specific month you identified. For example, if the vehicle was first used in July 2018, the due date for filing is August 31, 2018.

- Fill out the necessary fields on the IRS 2290 form, ensuring all vehicle details, such as VIN and weight class, are accurate.

- Verify that all information provided is correct and complete, as any errors may delay the processing of your form.

- Submit the completed form and make your payment by the due date specified in the table. Remember, if the due date falls on a weekend or holiday, you may submit it the next business day.

- Once submitted, you can save the changes, download a copy of the completed form, print it, or share it as necessary.

Take action now to complete your IRS 2290 form online, ensuring timely compliance with tax regulations.

Related links form

You can check the status of your Form 2290 by using the IRS online system or contacting your e-file provider. After submission, tracking your form is essential to ensure everything is processed correctly before the IRS 2290 due dates. If you filed through US Legal Forms, they often provide status updates, making the follow-up easier for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.