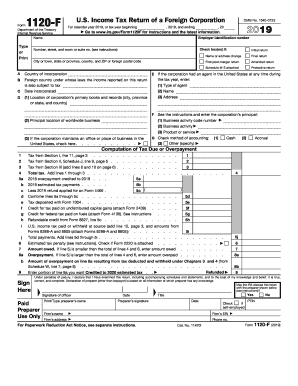

Get Irs 1120-f 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120-F online

How to fill out and sign IRS 1120-F online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If individuals aren’t linked to document management and legal procedures, completing IRS forms will be exceptionally challenging. We understand the importance of accurately finishing paperwork.

Our platform provides the solution to streamline the process of handling IRS forms as effortlessly as possible. Adhere to this guide to swiftly and accurately fill out IRS 1120-F.

Utilizing our online tool can certainly make professional completion of IRS 1120-F a reality. We will handle everything for your convenience and efficiency.

- Click on the button Get Form to access it and start editing.

- Complete all required fields in the document using our beneficial PDF editor. Activate the Wizard Tool to make the process even simpler.

- Verify the accuracy of the information provided.

- Insert the date of completing IRS 1120-F. Utilize the Sign Tool to create a unique signature for document authentication.

- Finish editing by clicking Done.

- Submit this document directly to the IRS in the most convenient way for you: via email, using digital fax, or postal service.

- You have the option to print it out on paper when a hard copy is needed and download or save it to your desired cloud storage.

How to modify Get IRS 1120-F 2019: tailor forms online

Bid farewell to a conventional paper-based approach to managing Get IRS 1120-F 2019. Complete the document and sign it in moments with our expert online editor.

Are you finding it difficult to modify and complete Get IRS 1120-F 2019? With a professional editor like ours, you can achieve this task in just a few moments without needing to print and scan documents repeatedly. We provide fully customizable and user-friendly document templates that will kickstart the process and assist you in completing the necessary document template online.

All files automatically include fillable fields you can utilize as soon as you access the document. However, if you wish to refine the current content or insert new information, you can select from various customization and annotation features. Emphasize, obscure, and comment on the text; add checkmarks, lines, text boxes, images, notes, and remarks. Furthermore, you can swiftly verify the document with a legally valid signature. The finished document can be shared with others, stored, sent to external applications, or converted into any common format.

You’ll never regret choosing our online tool to manage Get IRS 1120-F 2019 because it is:

Don’t squander time handling your Get IRS 1120-F 2019 the outdated way - with pen and paper. Opt for our comprehensive tool instead. It provides you with an extensive range of editing features, built-in eSignature abilities, and user-friendliness. What sets it apart is the team collaboration features - you can collaborate on documents with anyone, establish a well-organized document approval process from start to finish, and so much more. Test our online tool and gain the best return on your investment!

- Simple to set up and use, even for users who haven’t completed documents electronically before.

- Sturdy enough to meet various editing requirements and document varieties.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible across multiple operating systems, making it easy to finalize the document from anywhere.

- Able to generate forms based on pre-designed templates.

- Compatible with numerous file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

Yes, you can file form 1120 yourself, but it's essential to understand the complexities involved. If you’re familiar with tax regulations, self-filing is an option. However, using a platform like US Legal Forms can simplify the process and reduce the risk of errors.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.