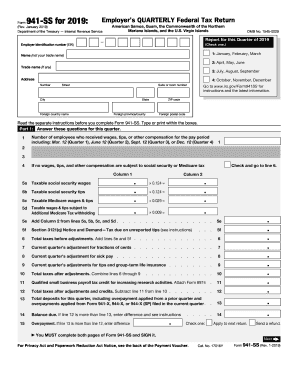

Get Irs 941-ss 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 941-SS online

How to fill out and sign IRS 941-SS online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When people aren’t linked to document organization and legal procedures, finalizing IRS papers can be exceedingly challenging. We recognize the importance of accurately completing forms.

Our platform provides the remedy to simplify the process of filling out IRS documents as much as possible. Adhere to these suggestions to correctly and swiftly file IRS 941-SS.

Utilizing our online application can undoubtedly facilitate professional completion of IRS 941-SS. Make everything for your ease and efficient work.

Press the button Get Form to access it and begin editing.

Complete all necessary fields in the document using our expert PDF editor. Activate the Wizard Tool to make the process even easier.

Verify the accuracy of the provided information.

Incorporate the date of submitting IRS 941-SS. Use the Sign Tool to provide your signature for the document validation.

Conclude the modifications by selecting Done.

Submit this document to the IRS in the most convenient way for you: through email, using digital fax, or postal service.

You can print it out on paper if a copy is needed and download or save it to your preferred cloud storage.

How to modify Get IRS 941-SS 2019: personalize forms online

Your easily amendable and customizable Get IRS 941-SS 2019 template is at your fingertips. Take advantage of our collection with an integrated online editor.

Do you hesitate to finish Get IRS 941-SS 2019 because you simply don't know where to start and how to proceed? We comprehend your sentiments and have an excellent solution for you that has nothing to do with conquering your delay!

Our online selection of ready-to-edit templates allows you to sift through and pick from thousands of fillable documents tailored for various purposes and situations. However, acquiring the document is merely the beginning. We offer you all the essential tools to complete, validate, and alter the document of your preference without exiting our site.

All you have to do is open the document in the editor. Examine the wording of Get IRS 941-SS 2019 and confirm whether it aligns with your needs. Start finalizing the template by employing the annotation features to give your document a more structured and polished appearance.

To summarize, alongside Get IRS 941-SS 2019, you'll receive:

With our premium option, your finalized documents will nearly always be legally binding and completely encrypted. We assure the protection of your most sensitive information.

Obtain what is necessary to create a professional-looking Get IRS 941-SS 2019. Make the right decision and test our platform now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, obscure, and amend the existing text.

- If the document is intended for others as well, you can include fillable fields and distribute them for other individuals to complete.

- Once you finish completing the template, you can download the file in any available format or select any sharing or delivery options.

- A robust suite of editing and annotation tools.

- An integrated legally-binding eSignature capability.

- The ability to create documents from scratch or based on the pre-prepared template.

- Compatibility with various platforms and devices for enhanced convenience.

- Multiple options for securing your files.

- A variety of delivery methods for simplified sharing and dispatching of documents.

- Adherence to eSignature regulations governing the use of eSignature in online transactions.

Get form

Related links form

To mail your IRS 941-SS form without a payment for the year 2025, send it to the address indicated in the IRS instructions for that form. Ensure you use the appropriate mailing address based on your organization's location and the specific form instructions. If you need assistance, platforms like USLegalForms offer guidance on how to complete and send your forms correctly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.