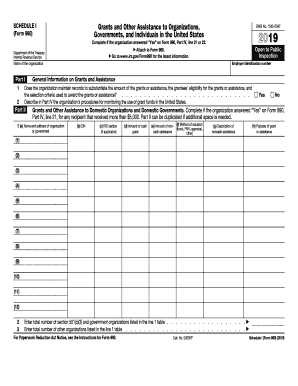

Get Irs 990 - Schedule I 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990 - Schedule I online

How to fill out and sign IRS 990 - Schedule I online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When you aren't linked with document handling and legal processes, completing IRS paperwork can be quite stressful. We understand the importance of accurately finalizing documents. Our service provides the functionality to streamline the process of submitting IRS forms as effortlessly as possible.

Follow these instructions to accurately and swiftly complete IRS 990 - Schedule I.

Utilizing our comprehensive solution will enable proficient completion of IRS 990 - Schedule I, creating everything for your ease and comfort.

- Click on the button Get Form to access it and start editing.

- Complete all required fields in the document using our advanced PDF editor. Activate the Wizard Tool to simplify the process.

- Ensure the accuracy of the entered information.

- Include the date of completion for IRS 990 - Schedule I. Utilize the Sign Tool to create your unique signature for document validation.

- Conclude editing by selecting Done.

- Send this document directly to the IRS in the most convenient way for you: via email, using digital fax, or postal service.

- You can print it out if a hard copy is necessary and download or save it to your preferred cloud storage.

How to Modify Get IRS 990 - Schedule I 2019: Personalize Forms Online

Forget the traditional paper-based method of filling out Get IRS 990 - Schedule I 2019. Have the form finalized and signed promptly with our expert online editor.

Are you finding it difficult to edit and complete Get IRS 990 - Schedule I 2019? With a professional editor like ours, you can achieve this in just minutes without needing to print and scan documents repeatedly.

We offer fully adjustable and user-friendly document templates that will serve as a foundation and assist you in completing the necessary form online.

All forms automatically include fillable fields you can operate once the form is opened. However, if you wish to enhance the existing content of the document or add new information, you can choose from various editing and annotation tools. Emphasize, obscure, and comment on the text; add checkmarks, lines, text boxes, visuals, notes, and remarks. Furthermore, you can quickly validate the form with a legally-binding signature. The finalized document can be shared with others, stored, transmitted to external applications, or converted into different formats.

Don't waste time editing your Get IRS 990 - Schedule I 2019 the traditional way - with pen and paper. Opt for our comprehensive solution instead. It offers you a versatile array of editing tools, built-in eSignature features, and convenience. What sets it apart is the team collaboration capabilities - you can work on forms with anyone, develop a well-organized document approval workflow from the start, and much more. Test our online tool and get maximum value!

- Simple to establish and utilize, even for individuals who haven’t handled paperwork electronically before.

- Powerful enough to accommodate diverse modification needs and document types.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible across various operating systems, making it easy to complete the document from almost anywhere.

- Able to create forms using premade templates.

- Compatible with a wide range of file formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

Related links form

Yes, if your nonprofit's gross receipts exceed $200,000 or its total assets are greater than $500,000, it is required to file Form 990 annually. This form is vital for ensuring compliance with IRS regulations and maintaining transparency. If you are uncertain about your filing requirements, platforms like US Legal Forms can guide you through the regulations and support you in completing the necessary forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.