Get Irs 4419 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4419 online

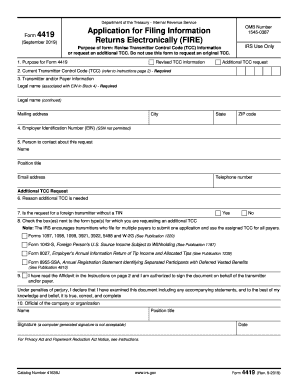

Filling out the IRS 4419 form is an essential step for those needing to revise their Transmitter Control Code (TCC) information or to request an additional TCC for electronic filing. This guide provides a comprehensive overview of each section of the form to assist you in completing it accurately and efficiently.

Follow the steps to fill out the IRS 4419 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Indicate the purpose for completing the form by checking the appropriate box in Block 1, specifying if it is for revised TCC information or an additional TCC request.

- Enter your current TCC in Block 2, which is a required field.

- In Block 3, provide the legal name associated with your Employer Identification Number (EIN), followed by your mailing address, including city, state, and ZIP code.

- Enter your EIN in Block 4. Note that a Social Security Number is not permitted.

- In Block 5, fill in the name, position title, email address, and telephone number of the person to contact about this application.

- If you are requesting an additional TCC, provide the reason for the request in Block 6.

- Check the appropriate box in Block 7 if the request is for a foreign transmitter without a TIN.

- In Block 8, select the box(es) next to the form type(s) for which you are requesting an additional TCC. Each checked box will generate a separate TCC.

- In Block 9, confirm that you have read the affidavit and are authorized to sign on behalf of the transmitter and/or payer.

- Complete Block 10 by entering the name and position title of the official signatory, along with their signature (a computer-generated signature is not acceptable) and the date.

- Once you have filled out all required fields, save your changes, download, print, or share the completed form as needed.

Start filling out your IRS 4419 form online today to ensure timely processing of your TCC requests.

Get form

Related links form

You qualify as insolvent when your total liabilities surpass your total assets. This financial status can impact your tax situation in significant ways, including how you manage debt. It’s important to consult with financial professionals to explore your options. Understanding your insolvency status early can provide direction in resolving your financial obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.