Get Irs 1065 - Schedule K-1 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1065 - Schedule K-1 online

How to fill out and sign IRS 1065 - Schedule K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the fiscal period commenced unexpectedly or perhaps you simply overlooked it, it could likely result in issues for you.

IRS 1065 - Schedule K-1 is not the simplest form, but there is no reason to panic in any case.

With our robust digital solution and its helpful tools, submitting IRS 1065 - Schedule K-1 becomes increasingly efficient. Don’t hesitate to try it and allocate more time to hobbies and interests instead of paperwork.

Access the file in our specialized PDF editor.

Complete all the necessary information in IRS 1065 - Schedule K-1, using the fillable fields.

Add images, ticks, checkmarks, and text boxes, if necessary.

Subsequent fields will be automatically populated after the first entry.

If there are any confusions, utilize the Wizard Tool. You will receive some guidance for easier submission.

Always remember to include the date of application.

Create your unique electronic signature once and place it in all the required areas.

Review the information you have entered. Rectify any mistakes if needed.

Press Done to complete the editing and choose how you will transmit it. You will have the option to use digital fax, USPS, or email.

You can download the document to print it later or upload it to cloud storage.

How to Adjust Get IRS 1065 - Schedule K-1 2017: Tailor Forms Online

Select the appropriate Get IRS 1065 - Schedule K-1 2017 template and alter it instantly.

Optimize your documentation with a clever form editing solution for internet-based forms.

Your daily routine with documents and forms can become more effective when you have all necessary items centralized.

For example, you can locate, obtain, and change Get IRS 1065 - Schedule K-1 2017 within a single web browser tab. If you’re seeking a specific Get IRS 1065 - Schedule K-1 2017, it’s straightforward to discover it using the intelligent search engine and access it immediately. You don’t have to download it or search for an outside editor to change it and input your details. All the resources for effective work come in one comprehensive solution.

Engage in more personalized modifications with the available tools.

- This editing tool allows you to personalize, complete, and endorse your Get IRS 1065 - Schedule K-1 2017 form directly.

- After locating the suitable template, click on it to initiate editing mode.

- Once you have the form in the editor, all essential tools are within easy reach.

- It’s simple to populate the designated fields and eliminate them if needed using a straightforward yet versatile toolbar.

- Apply all modifications immediately and sign the document without leaving the tab by merely clicking the signature field.

Get form

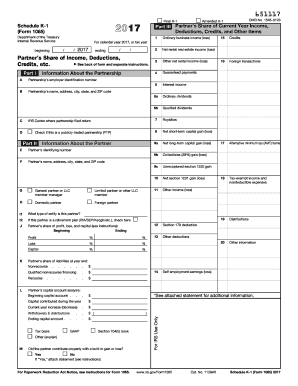

IRS Schedule K-1 is filed by partnerships who are required to report each partner's share of income, deductions, and credits. It ensures transparency among partners about their financial contributions. After preparing this form, the partnership distributes it to each partner so that they can report it on their individual tax returns. This collaborative approach helps maintain compliance with the IRS.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.