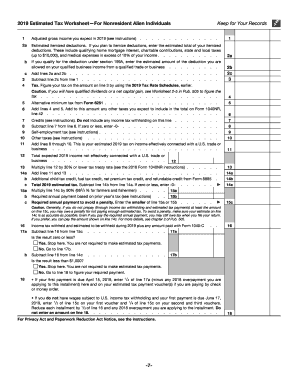

Get Irs 1040-es (nr) 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040-ES (NR) online

How to fill out and sign IRS 1040-ES (NR) online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When tax season starts suddenly or if you simply overlook it, it could potentially create issues for you. IRS 1040-ES (NR) isn't the simplest form, but there’s no need to panic in any situation.

By utilizing our robust online software, you'll discover how to complete IRS 1040-ES (NR) even in circumstances of significant time constraints. Just adhere to these straightforward instructions:

With our effective digital solution and its handy tools, completing IRS 1040-ES (NR) becomes easier. Feel free to engage with it and allocate more time to pursuits you enjoy rather than preparing documents.

Access the document with our expert PDF editor.

Input all the required information in IRS 1040-ES (NR) by using the fillable fields.

Add images, check marks, and text boxes if necessary.

Repeated information will auto-fill after the initial entry.

If you encounter any difficulties, activate the Wizard Tool. You'll receive guidance for easier completion.

Always remember to add the application date.

Create your distinct e-signature once and position it in the designated areas.

Review the details you’ve entered. Rectify any errors if necessary.

Click Done to finish editing and choose your preferred method for submission. You can opt for virtual fax, USPS, or email.

It enables you to download the document for later printing or upload it to cloud storage services like Google Drive, Dropbox, etc.

How to alter Get IRS 1040-ES (NR) 2019: personalize forms online

Put the appropriate document modification capabilities at your disposal. Execute Get IRS 1040-ES (NR) 2019 with our trustworthy solution that merges editing and eSignature functionality.

If you wish to execute and sign Get IRS 1040-ES (NR) 2019 online without any hassle, then our cloud-based option is the best choice. We offer an extensive template-driven catalog of ready-to-edit documents that you can customize and finalize online. Additionally, there is no need to print the document or utilize external options to make it fillable. All essential features are accessible once you open the file in the editor.

Let’s explore our online editing capabilities and their key features. The editor boasts a user-friendly interface, so it won't take long to become familiar with it. We’ll review three principal sections that allow you to:

Beyond the functionalities listed above, you can protect your file with a password, apply a watermark, convert the file to the required format, and much more.

Our editor simplifies modifying and certifying the Get IRS 1040-ES (NR) 2019. It allows you to do virtually everything concerning form management. Furthermore, we ensure that your file editing experience is secure and complies with major regulatory standards. All these features enhance the enjoyment of utilizing our solution.

Obtain Get IRS 1040-ES (NR) 2019, make the necessary edits and adjustments, and receive it in your desired file format. Give it a try today!

- Revise and annotate the template

- The upper toolbar includes the tools that assist you in emphasizing and obscuring text, excluding images and image elements (lines, arrows, and checkmarks, etc.), adding your signature, initializing, dating the form, and more.

- Organize your documents

- Utilize the left toolbar if you wish to rearrange the form or/and eliminate pages.

- Prepare them for distribution

- To make the document fillable for others and share it, you can employ the tools on the right to add various fillable fields, signature and date, text boxes, etc.

Get form

Related links form

You report your estimated tax payments on your tax return by including them on the form that corresponds with your tax situation. For example, if you're using the IRS 1040-ES (NR) form, you will enter your estimated payments on the designated lines. Keeping a detailed record of these payments can simplify the process and help you avoid any potential penalties.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.