Get Irs Instruction 1065 - Schedule K-1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1065 - Schedule K-1 online

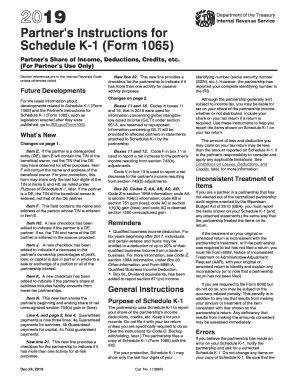

Filling out the IRS Schedule K-1 (Form 1065) can be a complex process, especially for those unfamiliar with the intricacies of partnership taxation. This guide provides a clear, step-by-step approach to help you complete this important form online, ensuring that you accurately report your share of the partnership's income, deductions, and credits.

Follow the steps to complete your Schedule K-1 online effectively.

- Press the ‘Get Form’ button to access the Schedule K-1 form and open it in your digital editor.

- Review Part I, where you will enter information about the partnership. Include the name, address, and partnership's employer identification number (EIN). Ensure that the information is up to date and accurately reflects the partnership's details.

- Move to Part II, which contains your information as the partner. Fill in your name, address, and taxpayer identification number (TIN). If you are a disregarded entity, ensure that the beneficial owner's TIN is correctly reported.

- In Part III, report your share of the partnership's income, deductions, and credits in boxes 1 to 20. Pay special attention to any codes that apply to specific types of income or deductions, such as section 179 deductions or tax-exempt income.

- If applicable, indicate any changes in your ownership percentages in Item J and report your share of partnership liabilities in Item K. This information may affect your at-risk calculations.

- Review the instructions for boxes that may require additional information or forms, such as passive activity limitations or foreign transactions.

- Once all sections are filled out accurately, check for any errors or omissions. Make any necessary corrections to ensure compliance with IRS guidelines.

- Finally, save your changes, and you may choose to download, print, or share your completed Schedule K-1 as needed.

Get started on completing your IRS Form 1065 Schedule K-1 online today!

Get form

Related links form

The time it takes to receive a Schedule K-1 can vary based on the entity’s schedule and filing process. Typically, you should expect to receive it by the tax filing deadline, but delays can occur. Utilizing resources from U.S. Legal Forms can help you track down your Schedule K-1 forms swiftly, all while adhering to IRS Instruction 1065 - Schedule K-1.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.