Loading

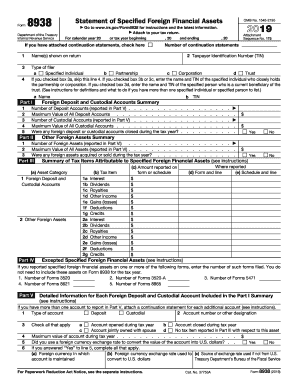

Get Irs 8938 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8938 online

Filing the IRS Form 8938, which details specified foreign financial assets, is essential for taxpayers with foreign financial interests. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin the form by entering the calendar year for which you are filing and your name as it appears on your tax return. Select the type of filer that applies to you, such as specified individual, partnership, corporation, or trust.

- Provide your Taxpayer Identification Number (TIN) and any relevant information based on the type of filer you selected. For partnerships or corporations, enter the TIN of the specified individual who closely holds that entity.

- Complete Part I by summarizing your foreign deposit and custodial accounts. Input the number of deposit accounts, maximum values, and indicate if any accounts were closed during the tax year.

- Move on to Part II to report other foreign assets. Specify the asset categories and provide the corresponding reported amounts on forms or schedules.

- In Part III, summarize tax items attributable to the specified foreign financial assets, ensuring you report any earnings such as interest, dividends, and royalties.

- Complete Part IV by detailing the number of foreign assets you are reporting and their maximum values, alongside confirming if any foreign assets were acquired or sold during the tax year.

- Part V requires detailed information about each foreign deposit and custodial account summarized earlier. For each account, provide the account number, type, values, and other necessary details, including whether any transactions like opening or closing occurred during the year.

- In Part VI, report on each 'other foreign asset', filling in any additional necessary information similarly to Part V.

- Finally, review the entire form for accuracy. After ensuring all information is correct, save your changes, and if needed, download, print, or share the completed form as required.

Complete your IRS 8938 filing online today to ensure compliance with your reporting obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you forget to file IRS 8938, you might face significant penalties, including fines and interest on any unpaid taxes. The IRS allows for late submissions under certain circumstances, but it is best to address any missing filings promptly. We recommend using uslegalforms to guide you through the process of rectifying this oversight.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.