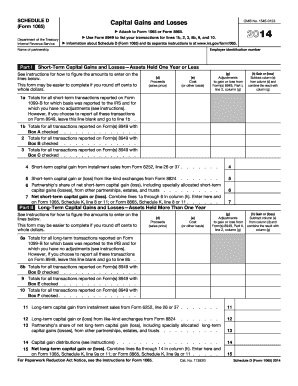

Get Irs 1065 - Schedule D 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1065 - Schedule D online

How to fill out and sign IRS 1065 - Schedule D online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax period commenced unexpectedly or you simply overlooked it, it may likely cause issues for you. IRS 1065 - Schedule D is not the simplest, but there's no reason to panic in any situation.

By utilizing our expert service, you will discover the best ways to fill out IRS 1065 - Schedule D, even in scenarios of significant time constraints. Just follow these straightforward instructions:

Utilizing our comprehensive digital solution and its advantageous tools makes completing IRS 1065 - Schedule D much easier. Do not hesitate to try it and allocate more time to leisure activities instead of document preparation.

Access the document with our expert PDF editor.

Complete the necessary information in IRS 1065 - Schedule D, by utilizing fillable fields.

Add graphics, crosses, checkboxes, and text boxes, if desired.

Recurrent details will be filled in automatically after the initial entry.

If you encounter any difficulties, activate the Wizard Tool. You will receive some advice for easier completion.

Remember to include the date of submission.

Create your unique signature once and place it where needed.

Review the information you have entered. Correct any errors if needed.

Click on Done to finish editing and choose how you will send it. You can utilize online fax, USPS, or email.

You can also download the file for later printing or upload it to cloud storage platforms like Dropbox, OneDrive, etc.

How to modify Get IRS 1065 - Schedule D 2014: personalize forms online

Utilize our sophisticated editor to transform a basic online template into an accomplished document. Continue reading to discover how to adjust Get IRS 1065 - Schedule D 2014 online effortlessly.

Once you find a suitable Get IRS 1065 - Schedule D 2014, all you have to do is tailor the template to your preferences or legal obligations. Besides filling the editable form with precise information, you may need to delete any sections in the document that are not pertinent to your situation. Alternatively, you might want to incorporate some absent clauses in the original template. Our sophisticated document editing features are the easiest method to correct and modify the document.

The editor allows you to amend the content of any form, even if the document is in PDF format. You can insert and remove text, include fillable fields, and implement other modifications while preserving the original layout of the document. You can also rearrange the form’s structure by altering the order of pages.

There’s no need to print the Get IRS 1065 - Schedule D 2014 to endorse it. The editor includes electronic signature capabilities. Most forms already possess signature fields. Therefore, you just need to append your signature and request one from the other signing party via email.

Follow this step-by-step tutorial to develop your Get IRS 1065 - Schedule D 2014:

After all parties have signed the document, you will receive a signed copy that you can download, print, and distribute to others.

Our services allow you to save significant time and minimize the risk of errors in your documents. Enhance your document workflows with effective editing tools and a robust eSignature solution.

- Launch the chosen template.

- Employ the toolbar to modify the form according to your preferences.

- Fill in the form with accurate details.

- Click on the signature field and insert your eSignature.

- Send the document for signature to other signatories if required.

Get form

Related links form

You can file IRS Form 1065 yourself if you feel comfortable with tax documents and regulations. However, given the complexities involved, many choose to use a tax professional or services like LegalForms to ensure accuracy. Filing with assistance can help avoid costly mistakes and ensure compliance with IRS requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.