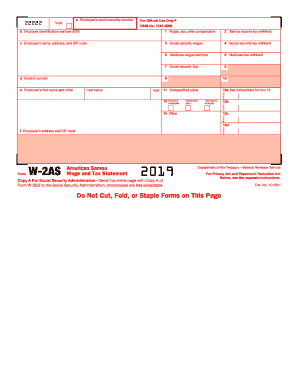

Get Irs W-2as 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2AS online

Filling out the IRS W-2AS form online is an essential task for employers in American Samoa to report employee wages and taxes accurately. This guide will provide you with a step-by-step approach to ensure that you correctly complete each section of the form, enabling you to fulfill your reporting obligations without hassle.

Follow the steps to complete the IRS W-2AS form online.

- Click the ‘Get Form’ button to obtain the W-2AS form and open it in your preferred online editor.

- Enter the employee’s social security number in the designated box labeled 'a'. This is a required field for identifying the employee uniquely.

- Provide the employer identification number (EIN) in box 'b', which is essential for tax purposes.

- Fill in the employer’s name, address, and ZIP code in box 'c' to ensure accurate contact information is available.

- In box '1', report the total wages, tips, and other compensations paid to the employee during the tax year.

- Indicate any Samoa income tax withheld in box '2', which reflects state obligations.

- Accurately report Social Security wages in box '3' and Social Security tax withheld in box '4'.

- Provide Medicare wages and tips in box '5' and any Medicare tax withheld in box '6'.

- If applicable, report Social Security tips in box '7'.

- Use box '12' to report any additional information, using the respective codes as applicable.

- Ensure that the employee’s first name, middle initial, last name, and suffix (if any) are correctly filled out in boxes 'e' and 'f'.

- Finally, after all entries are complete, save the changes, and choose to download or print the form for your records or for distribution to the employee.

Complete the IRS W-2AS form online today to ensure timely and accurate tax reporting.

Get form

The easiest way to get a W-2 is to request it directly from your employer. Most employers send out W-2 forms by the end of January each year, so keep an eye on your mailbox or email. If you need an electronic version, using the IRS W-2AS feature on US Legal Forms can expedite the process, making it simple to manage and obtain your tax forms quickly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.