Get Irs 1099-sa 2019-2025

How it works

-

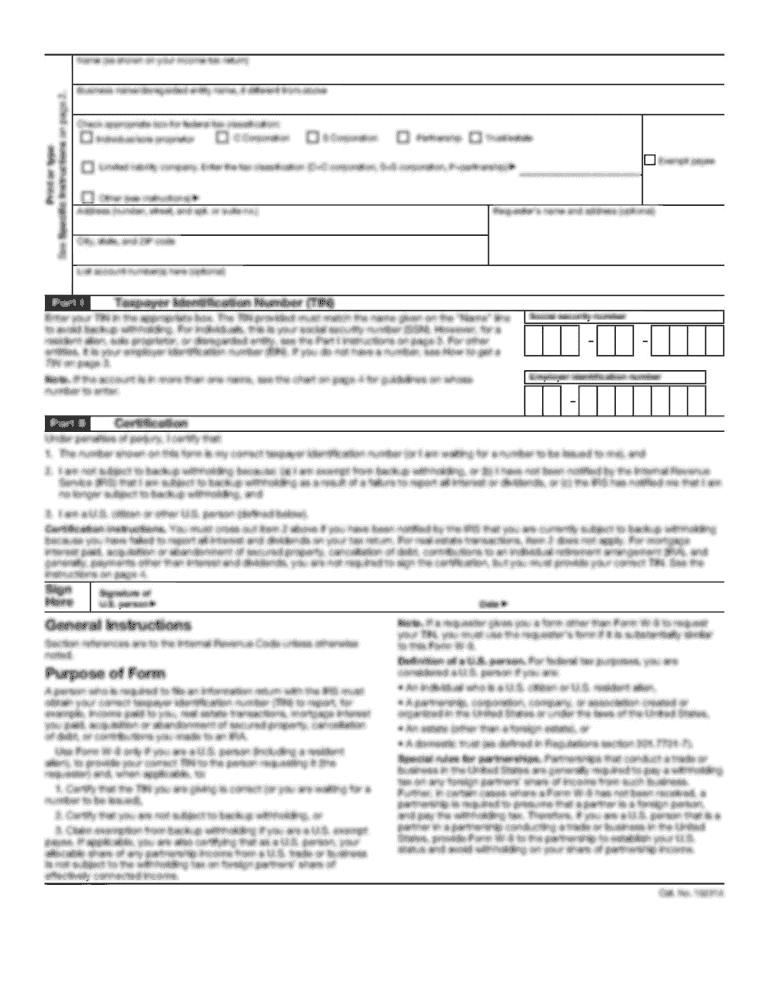

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1099-SA online

How to fill out and sign IRS 1099-SA online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you aren't linked with document management and legal procedures, completing IRS forms will be extremely challenging. We understand the significance of accurately filling out documents.

Our online application provides the answer to streamline the process of handling IRS forms as effortlessly as possible. Adhere to these suggestions to swiftly and accurately complete IRS 1099-SA.

Employing our online application can undoubtedly make professional completion of IRS 1099-SA a reality. Make everything for your ease and swift workflow.

Hit the button Get Form to access it and begin editing.

Fill in all necessary fields in the chosen document using our beneficial PDF editor. Activate the Wizard Tool to make the process even easier.

Verify the accuracy of the entered details.

Add the completion date of IRS 1099-SA. Utilize the Sign Tool to create a unique signature for the document's validation.

Finalize editing by selecting Done.

Submit this document to the IRS in the most convenient way for you: via email, using online fax, or postal mail.

You can print it on paper if a physical copy is necessary and download or save it to your preferred cloud storage.

How to Alter Obtain IRS 1099-SA 2019: Personalize Forms Online

Explore a singular service to handle all your documentation seamlessly. Locate, alter, and finalize your Obtain IRS 1099-SA 2019 in a unified interface with the assistance of intelligent tools.

The era when individuals had to print documents or even write them by hand is far behind us. Currently, all it requires to obtain and fill any form, like Obtain IRS 1099-SA 2019, is opening a single browser tab. Here, you will discover the Obtain IRS 1099-SA 2019 form and personalize it in whichever manner you need, from inserting text directly into the document to drawing it on a digital sticky note and attaching it to the file. Uncover tools that will simplify your documentation without additional effort.

Simply click the Obtain form button to swiftly prepare your Obtain IRS 1099-SA 2019 paperwork and start editing it right away. In the editing mode, you can effortlessly complete the template with your information for submission. Just click on the field you wish to alter and enter the data immediately. The editor's interface does not necessitate any specific skills to operate it. Once you’ve finished with the revisions, verify the information’s accuracy one last time and sign the document. Click on the signature field and follow the prompts to eSign the form in no time.

Utilize Additional tools to personalize your document:

Preparing Obtain IRS 1099-SA 2019 forms will never be confusing again if you know where to find the appropriate template and prepare it effortlessly. Don’t hesitate to give it a try yourself.

- Employ Cross, Check, or Circle tools to identify the document's information.

- Insert textual content or fillable text fields using text customization tools.

- Delete, Highlight, or Redact text portions in the document using respective tools.

- Add a date, initials, or even an image to the document if needed.

- Utilize the Sticky note tool to comment on the form.

- Use the Arrow and Line, or Draw tool to incorporate visual elements into your document.

You report an IRS 1099-S on Schedule D and Form 8949. These forms enable you to detail capital gains or losses resulting from the transaction reported on the 1099-S. Properly reporting this information helps maintain your compliance with IRS regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.