Loading

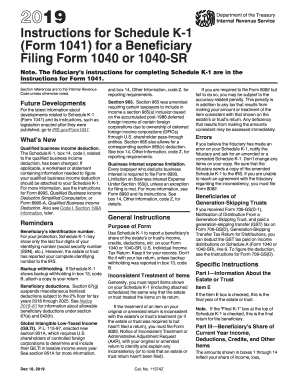

Get Irs Instructions 1041 - Schedule K-1 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instructions 1041 - Schedule K-1 online

This guide provides clear and supportive instructions for completing the IRS Schedule K-1 (Form 1041) online. Designed for beneficiaries, this document reports a share of an estate's or trust's income, deductions, and credits, crucial for your tax return.

Follow the steps to fill out your Schedule K-1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information as required in Part I—Information About the Estate or Trust. Ensure that you accurately fill out all fields, including the estate or trust name, and address, to prevent any discrepancies.

- In Part III—Beneficiary’s Share of Current Year Income, Deductions, Credits, and Other Items, refer to the boxes 1 through 14. Enter the amounts as they relate to your share from the estate or trust, including taxable interest, ordinary dividends, and capital gains.

- Carefully note any special codes listed next to the amounts in boxes 9 through 14. These may require additional information or forms that must be attached when filing your tax return.

- If applicable, review the instructions for the qualified business income deduction, found under box 14, code I, and attach any necessary worksheets or statements.

- Double-check all entries for accuracy against your records, including any correspondence you received from the fiduciary of the estate or trust.

- Once all fields are completed and reviewed, you can save the changes, download, print the Schedule K-1, or share it as required for your tax records.

Start filling out your IRS Schedule K-1 online today to ensure accurate reporting for your tax filings.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can file form 1041 electronically, which enhances its processing speed and security. Utilizing services that adhere to IRS Instructions 1041 - Schedule K-1 helps ensure accurate submissions. E-filing minimizes paperwork and can often simplify record-keeping. Make sure you are using software recommended by the IRS for this purpose.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.