Get Irs 1120-f - Schedule M-1 & M-2 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-F - Schedule M-1 & M-2 online

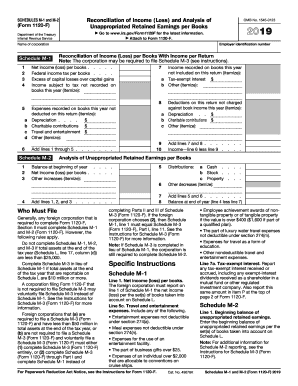

Filling out IRS 1120-F - Schedule M-1 & M-2 is essential for foreign corporations to reconcile income and analyze retained earnings. This guide provides a step-by-step approach to complete these schedules accurately online.

Follow the steps to complete your IRS 1120-F - Schedule M-1 & M-2.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Complete the employer identification number and the name of the corporation at the top of Schedule M-1. This information is essential for proper identification.

- Enter the net income (loss) per books on line 1 of Schedule M-1. This figure should reflect the corporate financials as recorded in your accounting records.

- Fill in federal income tax per books on line 2. This information should be derived from your corporate tax calculations.

- On line 3, document any excess of capital losses over capital gains, if applicable.

- Itemize income subject to tax that has not been recorded on books this year on lines 4 and 5. This can include tax-exempt interest and other types of income.

- For deductions not charged against book income, provide a breakdown on lines 6, 7, and 8, including depreciation and charitable contributions.

- Calculate the total on line 9 by adding lines 7 and 8. This will assist in deriving the adjusted total income for reporting.

- Proceed to Schedule M-2. Start with line 1, entering the beginning balance of unappropriated retained earnings as per your accounting records.

- Complete line 2 with net income (loss) as reported in Schedule M-1. Any other increases should be itemized accordingly.

- Finally, review all entries for accuracy. Save your changes, and you can either download, print, or share the completed document as necessary.

Start filling out your IRS 1120-F - Schedule M-1 & M-2 online today for accurate reporting.

Get form

Schedule M-2 serves the purpose of tracking unappropriated retained earnings for foreign corporations filing IRS 1120-F. This schedule provides clarity on the corporation's equity position over time, detailing amounts retained rather than distributed as dividends. Understanding Schedule M-2 is crucial for accurate reporting and compliance with tax obligations. USLegalForms can help you navigate this process, ensuring you meet your reporting requirements with ease.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.