Get Irs Schedule F Instructions 1040 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Schedule F Instructions 1040 Form online

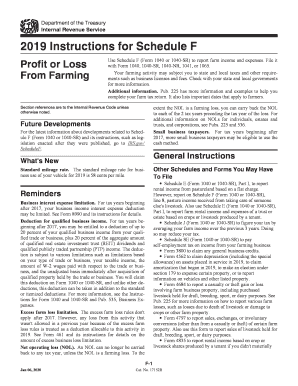

The Irs Schedule F Instructions 1040 Form is essential for reporting farm income and expenses. This guide offers clear, step-by-step instructions to help users complete the form online, ensuring they accurately report their farming activities.

Follow the steps to fill out the Irs Schedule F Instructions 1040 Form online

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your name and Social Security number in the appropriate fields at the top of the form. If you are filing as a married couple, include both names and identification numbers.

- On line B, indicate your principal agricultural activity by selecting from the provided list of agricultural activity codes.

- Choose your accounting method by checking the box for either 'Cash' or 'Accrual' based on how you report your income and expenses.

- Complete Part I by reporting your farm income, ensuring to include all relevant sources of income such as crop sales, livestock, and any government payments.

- In Part II, record your farm expenses. Be detailed in listing each expense category, including necessary documentation for deductions.

- Calculate your net profit or loss by subtracting total expenses from total income, and input this figure on line 34.

- Review your completed form for accuracy, ensuring all required fields are filled, then save your changes.

- Download, print, or share your completed Irs Schedule F Instructions 1040 Form as needed.

Start completing your Irs Schedule F Instructions 1040 Form online today!

Get form

Related links form

You qualify to file Schedule F if you earn income from farming activities that you treat as a business rather than a hobby. The IRS looks for evidence of a profit motive, demonstrated through your activities, documentation, and the nature of your expenses. To accurately determine your eligibility and file correctly, reference the IRS Schedule F instructions for the 1040 form and maintain organized records related to your farming operations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.