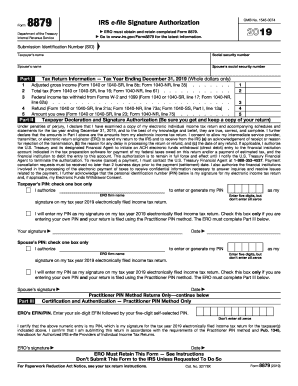

Get Irs 8879 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8879 online

How to fill out and sign IRS 8879 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When you aren't linked with document management and legal protocols, submitting IRS forms can be unexpectedly tiring.

We recognize the significance of accurately completing paperwork.

Utilizing our online software can definitely make professional completion of IRS 8879 a reality. We are committed to ensuring your work is comfortable and straightforward.

- Click on the button Get Form to access it and commence editing.

- Complete all required fields in the document utilizing our helpful PDF editor. Activate the Wizard Tool to simplify the process even further.

- Ensure the accuracy of the information filled in.

- Include the date of completion for IRS 8879. Use the Sign Tool to provide a personal signature for the document validation.

- Conclude editing by clicking Done.

- Transmit this document to the IRS in the most convenient manner for you: via email, utilizing digital fax, or postal service.

- You can print it on paper if a physical copy is required and download or save it to your selected cloud storage.

How to modify Get IRS 8879 2019: personalize forms online

Explore a comprehensive service to handle all of your documents seamlessly. Locate, modify, and complete your Get IRS 8879 2019 in a single platform with the assistance of intelligent tools.

The days when individuals had to print forms or even fill them out by hand are gone. Nowadays, all it requires to locate and finish any form, such as Get IRS 8879 2019, is opening a singular browser window. Here, you can access the Get IRS 8879 2019 form and tailor it as per your requirements, from inputting text directly in the document to sketching it on a digital sticky note and linking it to the document. Discover resources that will ease your document preparation without extra toil.

Press the Get form button to organize your Get IRS 8879 2019 paperwork easily and begin editing it immediately. In the editing mode, you can swiftly finalize the template with your details for submission. Simply click on the section you wish to change and input the information right away. The editor's interface does not require any specialized skills to navigate it. When you are finished with the modifications, verify the accuracy of the information once again and sign the document. Click on the signature area and adhere to the instructions to eSign the form in no time.

Utilize Additional tools to personalize your form:

Completing Get IRS 8879 2019 forms will never be challenging again once you know where to seek the appropriate template and prepare it with ease. Do not hesitate to try it for yourself.

- Employ Cross, Check, or Circle tools to mark the document's data.

- Incorporate textual content or fillable text fields with text modification tools.

- Delete, Highlight, or Blackout text sections in the document using respective tools.

- Add a date, initials, or even an image to the document if needed.

- Utilize the Sticky note tool to comment on the form.

- Use the Arrow and Line, or Draw tool to insert visual elements into your document.

IRS form 8879 is the e-file Signature Authorization form used by taxpayers to electronically sign their tax returns. By signing this form, taxpayers authorize their tax preparers to file returns on their behalf, streamlining the overall e-filing process. Familiarizing yourself with IRS 8879 can make your tax season much smoother.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.