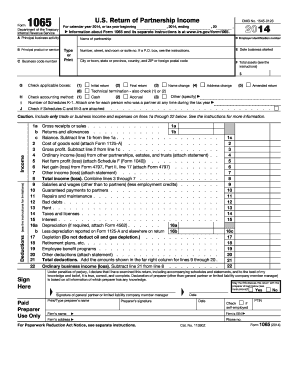

Get Irs 1065 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1065 online

How to fill out and sign IRS 1065 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

As the tax filing period starts unexpectedly or if it was simply overlooked, it may potentially lead to issues for you. IRS 1065 isn't the easiest form, but there's no reason to panic regardless.

By utilizing our ultimate platform, you will learn how to complete IRS 1065 even in time-critical situations. All you need to do is adhere to these straightforward instructions:

By utilizing our robust digital solution and its professional tools, submitting IRS 1065 becomes more convenient. Don't hesitate to take advantage of it, allowing you to dedicate more time to hobbies and interests rather than preparing paperwork.

- Access the document in our expert PDF editor.

- Enter all the necessary information in IRS 1065, utilizing the fillable fields.

- Add images, checkmarks, and text boxes as required.

- Repeated information will be automatically populated after the initial entry.

- If you encounter any challenges, activate the Wizard Tool. You will receive helpful hints for smoother submission.

- Remember to include the application date.

- Create your distinct signature once and place it in all required fields.

- Review the information you have provided. Amend any errors if necessary.

- Click on Done to complete the editing and choose your submission method. You can opt for online fax, USPS, or email.

- You may also download the document to print it later or upload it to cloud storage.

How to modify Get IRS 1065 2014: personalize forms online

Locate the appropriate Get IRS 1065 2014 template and adjust it immediately. Streamline your documentation with an advanced document editing tool for online forms.

Your everyday tasks with documentation and forms can be more productive when all your necessities are centralized. For instance, you can search for, acquire, and modify Get IRS 1065 2014 within a single browser tab. If you're looking for a particular Get IRS 1065 2014, it is easy to locate it using the intelligent search engine and access it instantly. You won’t need to download it or seek out a separate editor to modify it and input your details. All the resources for efficient work come in one all-inclusive package.

This editing tool empowers you to personalize, complete, and sign your Get IRS 1065 2014 form right away. When you find the suitable template, click it to enter the editing mode. Once the form is open in the editor, all the crucial tools are at your disposal. You can swiftly fill in the required fields and eliminate them if needed with the aid of a straightforward yet versatile toolbar. Implement all modifications immediately, and sign the document without navigating away from the tab by simply selecting the signature area. Subsequently, you can send or print your document if necessary.

Make additional custom alterations with the available tools.

Uncover new possibilities for effective and straightforward documentation. Find the Get IRS 1065 2014 you require in moments and complete it in the same tab. Eliminate the clutter in your paperwork for good with the help of online forms.

- Annotate your document using the Sticky note feature by placing a note anywhere in the file.

- Incorporate necessary visual elements, if desired, with the Circle, Check, or Cross tools.

- Alter or insert text anywhere in the document using Texts and Text box features. Include details with the Initials or Date tool.

- Adjust the template text with the Highlight, Blackout, or Erase tools.

- Add custom visual elements using the Arrow, Line, or Draw tools.

Get form

Form F 1065 is required to be filed by partnerships and LLCs that are treated as partnerships for federal tax purposes. If your business meets this classification, you must complete and submit this form to ensure proper reporting of income, credits, and deductions. Filing diligently helps maintain compliance with IRS requirements. US Legal Forms can provide the necessary forms and guidance to help you navigate this process smoothly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.