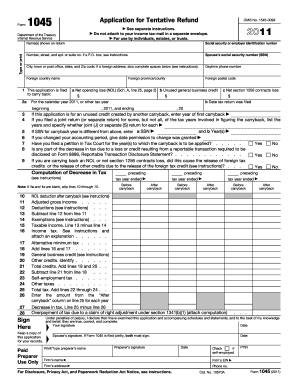

Get Irs 1045 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1045 online

How to fill out and sign IRS 1045 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When the tax season started unexpectedly or perhaps you just overlooked it, it could likely cause issues for you. IRS 1045 is not the simplest form, but you have no reason to be concerned under any circumstances.

Utilizing our professional online software, you will discover the most effective method to complete IRS 1045 in cases of significant time constraints. All you need to do is adhere to these straightforward directions:

With our robust digital solution and its beneficial tools, completing IRS 1045 becomes more manageable. Do not hesitate to try it out and allocate more time to enjoyable activities instead of handling paperwork.

Access the document with our advanced PDF editor.

Complete all the necessary information in IRS 1045, using fillable fields.

Incorporate visuals, marks, checkboxes, and text boxes if you prefer.

Repeated entries will be populated automatically after the initial input.

If you encounter any confusion, activate the Wizard Tool. You will receive some suggestions for easier completion.

Make sure to include the filing date.

Create your distinct e-signature once and place it in the required locations.

Review the information you have provided. Rectify errors if necessary.

Click Done to conclude editing and select your method of submission. You will have the option to utilize digital fax, USPS, or email.

You can download the document to print it later or upload it to cloud storage such as Google Drive, Dropbox, etc.

How to alter Get IRS 1045 2011: personalize forms online

Have the right document modification tools at your disposal. Accomplish Get IRS 1045 2011 with our reliable solution that integrates editing and eSignature capabilities.

If you aim to execute and validate Get IRS 1045 2011 online with ease, then our online cloud-based solution is the perfect option. We offer an extensive template-based library of ready-to-use forms that you can modify and complete online. Additionally, there's no need to print the document or rely on external tools to make it fillable. All essential features will be at your disposal as soon as you access the file in the editor.

Let’s explore our online editing features and their primary functions. The editor boasts an intuitive interface, ensuring that you won’t spend too much time learning how to use it. We’ll review three essential sections that enable you to:

Alongside the capabilities noted above, you can protect your file with a password, apply a watermark, convert the file into the desired format, and much more.

Our editor simplifies modifying and validating the Get IRS 1045 2011. It enables you to perform virtually everything regarding document management. Furthermore, we consistently ensure that your experience in editing documents is secure and adheres to primary regulatory standards. All these aspects make the use of our tool even more enjoyable.

Obtain Get IRS 1045 2011, make the necessary modifications and adjustments, and receive it in the desired file format. Try it today!

- Revise and annotate the template

- The upper toolbar includes functionalities to highlight and obscure text, devoid of pictures and image elements (lines, arrows, and checkmarks, etc.), add your signature, initialize, date the document, and more.

- Organize your documents

- Utilize the toolbar on the left if you intend to rearrange the document or/and eliminate pages.

- Prepare them for distribution

- If you want to make the document fillable for others and share it, you have the option to employ the tools on the right and incorporate various fillable fields, signature and date, text box, etc.

Get form

Related links form

Form 1045 should be filed by individuals or businesses that have experienced a net operating loss and wish to claim a refund. If you find yourself in a loss situation, utilizing IRS 1045 can provide crucial relief by enabling you to recover some taxes from prior years. Taxpayers who meet the criteria for the election should consider filing. Consulting a tax advisor can help you determine eligibility.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.