Get Ak Form 582 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 582 online

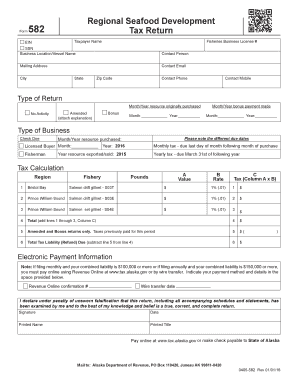

This guide provides a step-by-step approach to completing the AK Form 582 online. The form is essential for individuals and businesses involved in seafood development in Alaska to report their tax liabilities accurately.

Follow the steps to complete the AK Form 582 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the taxpayer name in the designated field. This should be the name of the individual or entity filing the form.

- Provide the Employer Identification Number (EIN), which is essential for establishing the taxpayer's identity.

- Input the Fisheries Business License number to indicate that you are a registered fishing business.

- Fill in the Social Security Number (SSN) for individual filers if applicable. For businesses, ensure to attach the EIN.

- Specify the business location or vessel name where operations are conducted.

- Complete the contact person’s information including name, mailing address, and contact details like email, phone, and mobile numbers.

- Select the type of return you are filing by checking the appropriate box: No Activity, Amended (attach an explanation), or Bonus.

- Indicate the month and year when the resource was originally purchased and the month and year when a bonus payment was made.

- Select the type of business by checking the relevant option under the designated section.

- For tax calculations, list relevant details including region, fishery, value in Column A, rate in Column B, and calculate the tax in Column C.

- Sum the total tax liability in the designated area, ensuring that you subtract any previously paid taxes if applicable.

- Complete the electronic payment information section, providing the Revenue Online confirmation number or wire transfer date if required.

- Lastly, complete the declaration statement, sign, and date the form, ensuring the printed name and title are also included.

- Upon completing the form, you can save changes, download, print, or share the filled-out form as necessary.

Complete your AK Form 582 online today to ensure accurate and timely submission.

Related links form

To claim withholding allowances, you must complete the Employee Withholding Exemption Certificate accurately. Indicate the appropriate number of allowances based on your financial situation to help control your withholding amounts. AK Form 582 can assist you in detailing these allowances correctly, allowing for an effective outcome while minimizing over-withholding. Regularly revisiting your allowances can ensure that they meet your current tax needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.