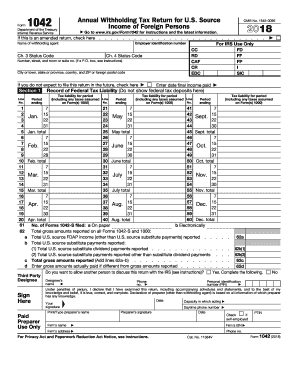

Get IRS 1042 2018

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 70b online

How to fill out and sign Nonfinancial online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period started unexpectedly or maybe you just forgot about it, it would probably cause problems for you. IRS 1042 is not the simplest one, but you do not have reason for worry in any case.

Making use of our ultimate online sofware you will learn the best way to complete IRS 1042 even in situations of critical time deficit. The only thing you need is to follow these easy guidelines:

-

Open the file with our powerful PDF editor.

-

Fill in all the details required in IRS 1042, making use of fillable fields.

-

Add images, crosses, check and text boxes, if required.

-

Repeating information will be filled automatically after the first input.

-

In case of troubles, switch on the Wizard Tool. You will see useful tips for simpler submitting.

-

Never forget to include the date of filing.

-

Create your unique e-signature once and put it in the required fields.

-

Check the details you have input. Correct mistakes if required.

-

Click Done to complete modifying and select how you will send it. You will find the opportunity to use digital fax, USPS or email.

-

Also you can download the document to print it later or upload it to cloud storage like Dropbox, OneDrive, etc.

Using our powerful digital solution and its beneficial tools, filling in IRS 1042 becomes more handy. Don?t hesitate to use it and spend more time on hobbies and interests rather than on preparing paperwork.

How to edit 11384v: customize forms online

Enjoy the functionality of the multi-featured online editor while filling out your 11384v. Make use of the variety of tools to quickly fill out the blanks and provide the required data right away.

Preparing documentation is time-consuming and pricey unless you have ready-to-use fillable templates and complete them electronically. The easiest way to deal with the 11384v is to use our professional and multi-functional online editing solutions. We provide you with all the essential tools for fast form fill-out and allow you to make any edits to your forms, adapting them to any demands. In addition to that, you can make comments on the updates and leave notes for other people involved.

Here’s what you can do with your 11384v in our editor:

- Fill out the blanks using Text, Cross, Check, Initials, Date, and Sign tools.

- Highlight significant information with a preferred color or underline them.

- Hide confidential data using the Blackout option or simply erase them.

- Import images to visualize your 11384v.

- Replace the original text using the one suiting your requirements.

- Add comments or sticky notes to inform others on the updates.

- Create extra fillable fields and assign them to exact recipients.

- Protect the sample with watermarks, place dates, and bates numbers.

- Share the document in various ways and save it on your device or the cloud in different formats as soon as you finish editing.

Dealing with 11384v in our robust online editor is the fastest and most productive way to manage, submit, and share your paperwork the way you need it from anywhere. The tool operates from the cloud so that you can access it from any location on any internet-connected device. All forms you create or fill out are safely stored in the cloud, so you can always open them whenever needed and be assured of not losing them. Stop wasting time on manual document completion and get rid of papers; make it all on the web with minimum effort.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing 62b

Watch our video to discover how you can easily complete the 63c and understand the advantages of using online templates. Simplify your paperwork with excellent web-based tools.

63b FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 1042

- 70a

- jan

- preparers

- FEB

- 62b

- 63c

- 63b

- overwithholding

- 70b

- 64e

- 62a

- Nonfinancial

- 11384v

- ptin

- 67b

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.