Loading

Get Irs 1041 - Schedule D 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule D online

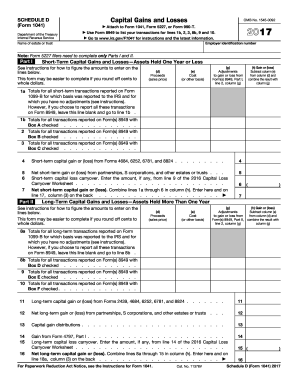

The IRS 1041 - Schedule D is a crucial form used to report capital gains and losses for estates and trusts. This guide will provide you with clear, step-by-step instructions on how to complete the form online, ensuring you have all the necessary information at your fingertips.

Follow the steps to successfully complete the IRS 1041 - Schedule D online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling out the header section with the decedent’s details and the trust or estate identification information. Ensure that you input the correct Employer Identification Number (EIN) and the name as it appears on the estate's tax record.

- Proceed to Part I, where you will report the capital gains and losses from the sales of assets. Enter each transaction's description, date acquired, date sold, proceeds, cost or other basis, and adjustments, if applicable. Make sure to double-check your entries for accuracy.

- Move on to Part II to summarize the totals from the transactions entered in Part I. This section will require you to calculate the net gain or loss and complete the respective fields for totals in each category.

- After completing Part I and II, review the completed form for any potential errors or omissions. It may be beneficial to have a second person review it as well to ensure all data is correctly entered.

- Once you have confirmed all information is accurate, save the form. You can also download a PDF version for your records, print a copy for submission, or share it as needed.

Start filing your IRS 1041 - Schedule D online today to ensure timely and accurate submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To access Schedule D on TurboTax, start by entering your capital gains and losses information in the relevant sections of the software. TurboTax will automatically generate IRS 1041 - Schedule D when it detects that you have transactions to report. The user-friendly interface guides you through the process, making it easy to complete.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.