Loading

Get Irs 1041 - Schedule D 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule D online

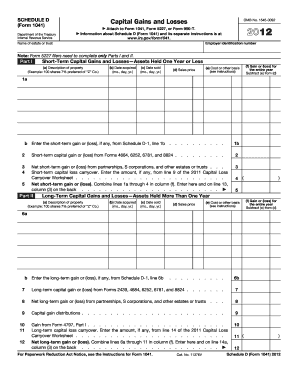

Filling out the IRS 1041 - Schedule D is essential for reporting capital gains and losses for estates and trusts. This guide provides a clear and detailed approach to help you complete the form effectively, ensuring you meet your reporting requirements.

Follow the steps to fill out the IRS 1041 - Schedule D.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In the top section, enter the employer identification number and the name of the estate or trust. These details are crucial for identifying the entity reporting the gains and losses.

- Move to Part I, which covers short-term capital gains and losses. List each asset held for one year or less, providing descriptions, acquisition and sale dates, costs, and sales prices.

- For each transaction in Part I, calculate the gain or loss by subtracting the cost (e) from the sales price (d). Enter the result in column (f).

- If applicable, input any short-term gains or losses from other schedules as directed.

- Proceed to Part II for long-term capital gains and losses. Similar to Part I, provide details for assets held more than one year.

- Calculate long-term gains or losses in the same manner as in Part I and record them in column (f).

- Complete the summary in Part III, adding up the net short-term and long-term gains or losses to report on the form.

- Follow through to Part IV to report any capital loss limitations, entering the smaller of the loss or $3,000.

- If necessary, complete Part V to calculate tax using maximum capital gains rates. This is applicable only under specific conditions outlined in the instructions.

- Finally, review your entries for accuracy, then save your changes, download or print the form for your records, and share as needed.

Begin completing the IRS 1041 - Schedule D online to ensure accurate reporting of your capital gains and losses.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can file a 1041 online through the IRS e-File system. Many tax preparation software platforms support electronic filing, making it more convenient for you. Utilizing these online resources can simplify the process, particularly when incorporating the IRS 1041 - Schedule D into your submission.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.