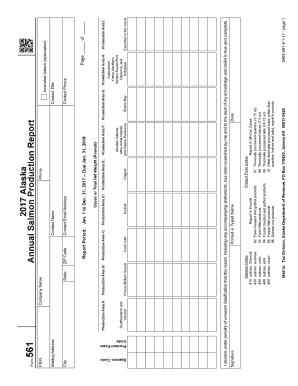

Get Ak Form 561 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AK Form 561 online

How to fill out and sign AK Form 561 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax interval began unexpectedly or perhaps you simply overlooked it, it could likely lead to complications for you.

AK Form 561 is not the simplest one, but you have no cause for concern in any event.

With this comprehensive digital solution and its effective tools, submitting AK Form 561 becomes more convenient. Don’t hesitate to utilize it and enjoy more time on leisure activities instead of on preparing documents.

- Access the document using our expert PDF editor.

- Complete the necessary information in AK Form 561, utilizing fillable fields.

- Add images, marks, checkboxes, and text boxes, if desired.

- Subsequent fields will be populated automatically after the initial entry.

- In case of confusion, activate the Wizard Tool. You will receive helpful hints for easier finalization.

- Remember to include the date of submission.

- Create your distinctive signature once and place it in all the required locations.

- Review the information you have inputted. Rectify errors if necessary.

- Click on Finished to complete the editing process and choose your delivery method. You will have the option to use digital fax, USPS, or email.

- You can download the document to print it later or upload it to cloud storage like Dropbox, OneDrive, etc.

How to modify Get AK Form 561 2017: personalize forms online

Experience a hassle-free and paperless method for modifying Get AK Form 561 2017. Utilize our reliable online service and save a significant amount of time.

Creating each document, including Get AK Form 561 2017, from the beginning requires excessive effort, thus having a proven platform of pre-loaded document templates can tremendously enhance your productivity.

However, adjusting them can be challenging, particularly with PDF files. Fortunately, our vast library includes an integrated editor that enables you to swiftly finalize and tailor Get AK Form 561 2017 without departing from our site, allowing you to avoid wasting time altering your forms. Here are the steps to manage your file using our tools:

Whether you aim to finalize editable Get AK Form 561 2017 or any other document available in our library, you’re on the right path with our online document editor. It's straightforward and secure and doesn’t necessitate any specialized skills. Our web-based solution is designed to tackle nearly everything you might envision related to file editing and management.

Ditch the traditional approach to handling your forms. Opt for a more effective solution that assists you in streamlining your duties and reducing paper dependency.

- Step 1. Find the required document on our platform.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize advanced modification tools that permit you to insert, delete, annotate, and emphasize or redact text.

- Step 4. Generate and append a legally-binding signature to your document by using the sign option located in the top toolbar.

- Step 5. If the form design doesn’t appear as needed, use the tools on the right to remove, add more, and rearrange pages.

- Step 6. Include fillable fields so additional individuals can be invited to complete the form (if necessary).

- Step 7. Share or distribute the document, print it, or select the format in which you’d prefer to download the file.

Related links form

Oklahoma Form 561 is a specific tax form used to claim the capital gains deduction provided by the state. It enables taxpayers to report their eligible capital gains and apply for any exemptions that may lower their overall tax liability. Understanding and correctly filling out AK Form 561 can be crucial for ensuring you receive all possible deductions, making it essential for Oklahoma taxpayers looking to manage their capital gains effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.