Get Ak Form 409 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 409 online

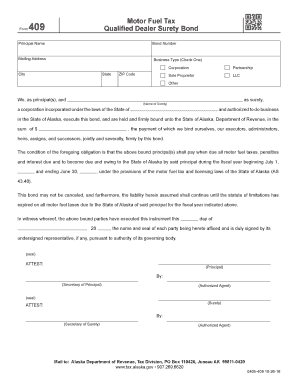

Filling out the AK Form 409, the qualified dealer surety bond, is essential for ensuring compliance with the motor fuel tax regulations in Alaska. This guide will provide clear, step-by-step instructions to help you complete the form accurately and effectively online.

Follow the steps to complete the AK Form 409 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the principal name in the designated field. This should be the legal name of the entity that is applying for the surety bond.

- Next, enter the bond number. This is a unique identifier for the bond and should be completed accurately.

- Fill out the mailing address, ensuring to include the complete address where correspondence related to this form should be sent.

- Select the business type by checking the appropriate box. Options include Corporation, Partnership, Sole Proprietor, LLC, or Other. Choose the one that accurately describes your business structure.

- Complete the city, state, and ZIP code fields. Ensure these details match the mailing address you previously entered.

- In the section regarding the surety, enter the name of the surety and the state of incorporation. Make sure this information is accurate as it relates to your bond.

- Enter the sum amount for which you are bound. This should reflect the total amount of motor fuel taxes that may be due.

- Provide the fiscal year dates where indicated, specifying the beginning and ending dates for the required tax obligations.

- At the bottom of the form, ensure that all parties duly sign the document. This includes signatures from authorized representatives of both the principal and surety.

- After completing the form, you can save your changes, download the form, print it for your records, or share it as needed.

Complete your AK Form 409 online today to ensure compliance with Alaska's motor fuel tax requirements.

On the employee's withholding exemption certificate, include information regarding the employee's exemption status, if applicable. This includes factors such as whether they qualify based on income level or tax liability. Providing accurate details helps prevent over-withholding or under-withholding taxes. For clarity on such exemptions, refer to the guidelines provided in the AK Form 409.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.