Loading

Get Irs 1040-pr 2007

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-PR online

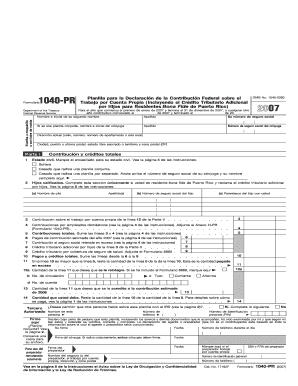

Filing the IRS 1040-PR online can be a straightforward process if you follow the right steps. This guide will provide you with detailed instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the IRS 1040-PR online.

- Click the ‘Get Form’ button to retrieve the IRS 1040-PR form and open it in your preferred editor.

- Enter your name and social security number at the top of the form. If you are filing jointly, include your partner's information as well.

- Specify your filing status by marking the appropriate checkbox for single, married filing jointly, or married filing separately.

- Complete the qualified children section only if you are a bona fide resident of Puerto Rico claiming the additional child tax credit.

- Fill in the self-employment income and any other relevant contributions and credits, following the instructions on the form carefully.

- Review the payments and credits section. Ensure you sum all payments to find the total payments and credits.

- Calculate the amount owed or the refund due. Enter this information as instructed.

- If you would like someone else to discuss your form with the IRS, fill out the authorized third party section.

- Sign and date the form, confirming that the information provided is true and complete.

- Finally, save your changes and choose to download, print, or share the completed IRS 1040-PR form.

Complete your IRS 1040-PR form online for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Income in Puerto Rico varies across industries and job sectors. Many residents earn income from tourism, manufacturing, and services, which contribute significantly to the local economy. When reporting income for tax purposes, it's essential to properly categorize and document it using IRS Form 1040-PR to ensure accurate filing and compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.