Get Irs 1040-pr 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-PR online

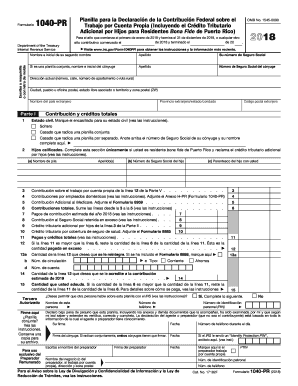

The IRS 1040-PR form is essential for individuals in Puerto Rico to report their self-employment income and claim credits. This guide provides a comprehensive overview of each section and field, ensuring you can fill out the form accurately and efficiently.

Follow the steps to complete the IRS 1040-PR online successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your first name, middle initial, and last name as they appear on your social security documents. If you are filing jointly, provide the same details for your partner.

- Fill in your social security number and, if applicable, your partner's social security number.

- Input your current address, including street number, apartment number if applicable, city, and postal code.

- Indicate your filing status by marking the appropriate box (Single, Married filing jointly, or Married filing separately).

- Complete the qualified children section if you are claiming the additional child tax credit. Provide the required details including names, social security numbers, and relationship.

- Fill in the total tax and credits in the appropriate fields by following the given instructions carefully.

- If applicable, enter information regarding estimated tax payments for the year and any credits you wish to claim.

- Review the form for any required signatures. Ensure both partners sign if filing jointly.

- Once all fields are complete, save your changes, and then you may download, print, or share the finalized document as needed.

Complete your IRS 1040-PR form online today to ensure accurate tax reporting.

Get form

Related links form

Puerto Rico is not a state; rather, it is a U.S. territory. As a territory, Puerto Rico has its own government and tax system, which can create some confusion regarding federal tax obligations. Although residents are U.S. citizens, they do not have the same tax obligations as those living in the states. Understanding the nuances of the IRS 1040-PR can help clarify your tax responsibilities while living in Puerto Rico.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.