Loading

Get Irs 1040-ez 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

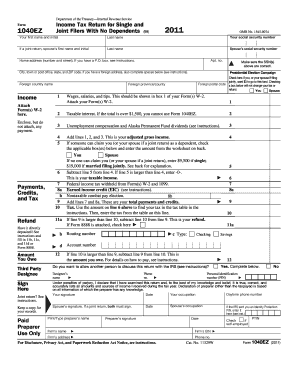

How to fill out the IRS 1040-EZ online

Filing your taxes can be a straightforward process, especially when using the IRS 1040-EZ form for simple tax situations. This guide will help you navigate the online process of completing this form effectively and accurately.

Follow the steps to complete the IRS 1040-EZ online.

- Click ‘Get Form’ button to obtain the IRS 1040-EZ form and open it in the editor.

- Enter your personal information, including your first name and initial, last name, and social security number in the designated fields. If filing jointly, include your spouse’s details as well.

- Fill in your home address. Include your apartment number (if applicable), city, state, and ZIP code. If you have a foreign address, provide the foreign country and postal code.

- Indicate your preference regarding the Presidential Election Campaign Fund by checking the appropriate box.

- Report your income. Start with line 1 for taxable interest and proceed with the wages from your W-2 forms, including any unemployment compensation listed on lines 2 and 3.

- Calculate your adjusted gross income by adding the amounts from lines 1, 2, and 3.

- If someone can claim you as a dependent, check the relevant box and refer to the worksheet on the back to determine your amount for line 5.

- Enter your total payments and credits on the relevant lines, including federal income tax withheld from your W-2.

- Using the tax table provided in the instructions, find your tax based on your taxable income and enter it on line 6.

- Determine if you are due a refund or owe additional taxes by completing lines 9 and 10.

- If expecting a refund, provide your banking details for direct deposit, specifying account type and routing number.

- Sign and date the return, making sure all information is accurate. If filing jointly, include your spouse's signature.

- Finally, save your completed form. You can download, print, or share it as needed for your records.

Complete your IRS 1040-EZ form online today to ensure a smooth and hassle-free tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

As of the 2018 tax year, the IRS has officially discontinued the IRS 1040-EZ form. They have combined it with the traditional 1040, which now includes a simplified version that meets the same needs. While it may seem confusing at first, the updated 1040 form offers clear sections for easy completion. Many find that our platform can help navigate these recent changes effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.