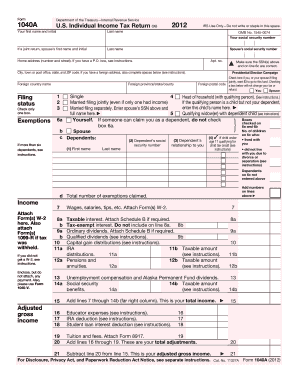

Get Irs 1040-a 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040-A online

How to fill out and sign IRS 1040-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax period began suddenly or perhaps you simply overlooked it, it might create difficulties for you.

IRS 1040-A isn't the most straightforward form, but you shouldn’t be concerned in any situation.

With our robust digital solution and its professional tools, completing IRS 1040-A becomes more efficient. Don’t hesitate to utilize it and enjoy more time on hobbies rather than preparing documents.

- Access the document in our expert PDF editor.

- Complete all necessary details in IRS 1040-A, using fillable fields.

- Incorporate images, marks, checkboxes, and text areas, if desired.

- Repeated information will be included automatically following the initial entry.

- If you encounter any issues, utilize the Wizard Tool. You will get helpful hints for easier submission.

- Remember to add the date of application.

- Create your personalized e-signature once and place it in all required spots.

- Review the information you have entered. Amend any errors if needed.

- Select Done to complete editing and decide how you will submit it. You’ll have the option to use digital fax, USPS, or email.

- You can also download the document to print it later or upload it to cloud storage platforms like Dropbox, OneDrive, etc.

How to revise Get IRS 1040-A 2012: personalize forms online

Utilize our extensive editor to convert a basic online template into a finalized document. Continue reading to discover how to alter Get IRS 1040-A 2012 online effortlessly.

Once you locate a suitable Get IRS 1040-A 2012, all you need to do is adapt the template to your specifications or legal stipulations. Besides completing the fillable form with precise details, you may need to eliminate some clauses in the document that are not pertinent to your situation. Conversely, you might want to include some absent conditions in the original template. Our sophisticated document editing tools are the optimal way to amend and adjust the form.

The editor permits you to modify the content of any form, even if the document is in PDF format. You can add and remove text, insert fillable fields, and perform additional changes while preserving the original formatting of the document. Moreover, you can rearrange the structure of the form by altering the page order.

You do not have to print the Get IRS 1040-A 2012 to authenticate it. The editor includes electronic signature functionalities. Most of the forms already have signature fields. Thus, you only need to add your signature and solicit one from the other signing parties with just a few clicks.

Follow this step-by-step guide to create your Get IRS 1040-A 2012:

Once all parties have signed the document, you will receive a signed copy which you can download, print, and share with others.

Our services allow you to save a significant amount of your time and reduce the likelihood of errors in your documents. Enhance your document workflows with efficient editing features and a robust eSignature solution.

- Open the chosen template.

- Utilize the toolbar to customize the form to your liking.

- Complete the form providing accurate details.

- Click on the signature field and append your electronic signature.

- Send the document for signature to additional signers if required.

Get form

Related links form

Yes, individuals over 65 are eligible for an additional standard deduction on their federal taxes. This benefit is designed to provide extra tax relief for seniors. To maximize your tax return, using the IRS 1040-A will help you ensure that you receive this additional deduction when filing.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.