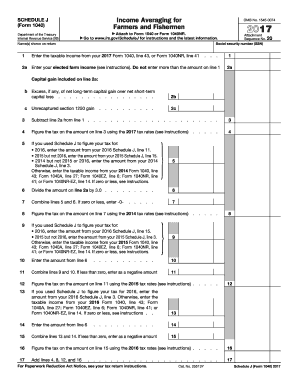

Get IRS 1040 Schedule J 2017

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Averaging online

How to fill out and sign Subtract online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period started unexpectedly or maybe you just forgot about it, it would probably create problems for you. IRS 1040 Schedule J is not the simplest one, but you do not have reason for worry in any case.

Utilizing our convenient solution you will see the best way to fill up IRS 1040 Schedule J in situations of critical time deficit. All you need is to follow these elementary guidelines:

-

Open the document with our powerful PDF editor.

-

Fill in the information needed in IRS 1040 Schedule J, using fillable lines.

-

Add photos, crosses, check and text boxes, if needed.

-

Repeating information will be filled automatically after the first input.

-

In case of troubles, turn on the Wizard Tool. You will get useful tips for much easier finalization.

-

Never forget to include the date of filing.

-

Draw your unique signature once and place it in the required fields.

-

Check the info you have included. Correct mistakes if needed.

-

Click Done to finalize editing and choose how you will deliver it. You will have the opportunity to use digital fax, USPS or electronic mail.

-

Also you can download the record to print it later or upload it to cloud storage like Google Drive, Dropbox, etc.

With this complete digital solution and its advantageous tools, filling out IRS 1040 Schedule J becomes more convenient. Don?t hesitate to work with it and have more time on hobbies rather than on preparing documents.

How to modify Dividends: customize forms online

Get rid of the mess from your paperwork routine. Discover the most effective way to find and edit, and file a Dividends

The process of preparing Dividends needs precision and attention, especially from people who are not well familiar with this type of job. It is important to find a suitable template and fill it in with the correct information. With the right solution for handling documents, you can get all the tools at hand. It is simple to simplify your editing process without learning new skills. Find the right sample of Dividends and fill it out immediately without switching between your browser tabs. Discover more tools to customize your Dividends form in the modifying mode.

While on the Dividends page, simply click the Get form button to start modifying it. Add your details to the form on the spot, as all the necessary tools are at hand right here. The sample is pre-designed, so the work required from the user is minimal. Just use the interactive fillable fields in the editor to easily complete your paperwork. Simply click on the form and proceed to the editor mode straight away. Fill in the interactive field, and your file is all set.

Try more tools to customize your form:

- Place more textual content around the document if needed. Use the Text and Text Box tools to insert text in a separate box.

- Add pre-designed visual components like Circle, Cross, and Check with respective tools.

- If needed, capture or upload images to the document with the Image tool.

- If you need to draw something in the document, use Line, Arrow, and Draw tools.

- Try the Highlight, Erase, and Blackout tools to change the text in the document.

- If you need to add comments to specific document sections, click the Sticky tool and place a note where you want.

Sometimes, a small error can ruin the whole form when someone completes it by hand. Forget about inaccuracies in your paperwork. Find the templates you need in moments and complete them electronically using a smart modifying solution.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing OMB

Learn how to fill in the taxable to increase your efficiency. Useful tips will allow you to complete a template in a much faster way and optimize how you spend your time.

Computation FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 1040 Schedule J

- 25513y

- schedulej

- SSN

- unrecaptured

- OMB

- taxable

- Computation

- worksheet

- averaging

- IRS

- gov

- subtract

- dividends

- attachment

- imposed

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.