Loading

Get Irs 1040 Schedule J 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule J online

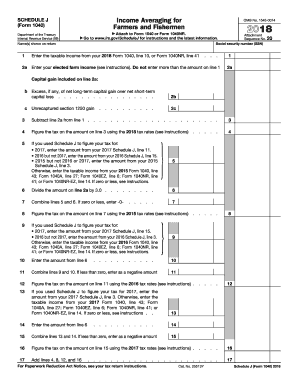

This guide provides clear instructions on how to complete the IRS 1040 Schedule J, a form used for income averaging by farmers and fishermen. Filling out this form online can streamline the process and ensure accuracy in your tax filings.

Follow the steps to fill out the IRS 1040 Schedule J online:

- Press the ‘Get Form’ button to access the IRS 1040 Schedule J form and open it in your preferred digital editor.

- Begin by entering your social security number (SSN) and the names as shown on your tax return.

- In line 1, input the taxable income from your 2018 Form 1040, line 10, or Form 1040NR, line 41.

- For line 2a, enter your elected farm income, ensuring it does not exceed the amount on line 1.

- Complete lines 2b and 2c if applicable, regarding capital gains and unrecaptured section 1250 gains.

- Subtract the amount on line 2a from line 1 to complete line 3.

- Calculate the tax on the amount from line 3 using the appropriate 2018 tax rates, and enter that amount on line 4.

- For line 5, refer back to prior Schedule J forms for values based on years 2015–2017 as specified, or input the required taxable income if not applicable.

- Divide the amount from line 2a by 3 to fill in line 6.

- Combine lines 5 and 6 to complete line 7, ensuring to enter -0- if the result is zero or less.

- Calculate the tax on line 7 using the 2015 tax rates and enter that amount on line 8.

- Repeat steps 8 and 9 for the years 2016 and 2017 as specified on lines 9 to 15, ensuring to calculate the respective taxes.

- Add lines 4, 8, 12, and 16 to find the total tax amount on line 17.

- Complete line 18 by entering the final total from line 17.

- Fill in lines 19 through 21 as per the guidelines, which require information from previous Schedule J forms or current taxable figures.

- Finally, compute the total tax on line 23 by subtracting line 22 from line 18, and include this amount on Form 1040, line 11, or Form 1040NR, line 42.

- After completing the form, ensure to save your changes and print or share the completed Schedule J as needed.

Start filing your IRS 1040 Schedule J online today to ensure accuracy and efficiency in your tax submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

IRS 1040 Schedule J is a specialized form used by farmers and fishermen for income averaging. It helps you, as a taxpayer in these industries, to report your earnings over a three-year period rather than a single year, providing potential tax advantages. If you need assistance with filling out this form, you can explore US Legal Forms for resources and supporting documentation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.