Loading

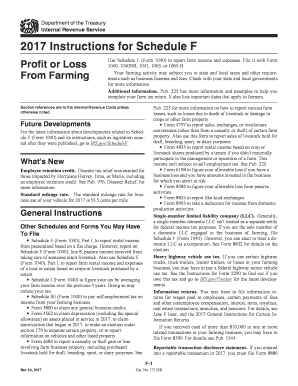

Get Irs 1040 Schedule F Instructions 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS 1040 Schedule F Instructions online

Filling out the IRS 1040 Schedule F is essential for reporting farm income and expenses. This guide provides step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out the IRS 1040 Schedule F Instructions online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Review the general instructions to understand the form’s purpose. Schedule F is used to report farm income and expenses. Ensure you have all necessary financial records at hand before proceeding.

- Locate Section A of the form which requires entering your principal agricultural activity code. Refer to the list provided in the instructions to select the code that best describes your farming activity.

- In Section B, check the appropriate box to indicate your accounting method, either 'Cash' or 'Accrual'. This decision impacts how you're reporting income and expenses.

- Complete Part I by entering your farm income from various sources, including sales, crop insurance proceeds, and cooperative distributions. Make sure to include all relevant income items.

- In Part II, detail your farm expenses. Provide accurate amounts for categories such as operating expenses, depreciation, and any other applicable deductions.

- Calculate your net profit or loss using the results from Parts I and II to determine whether you have a profit or allowable loss from your farming operations.

- Review all entries for accuracy and ensure that your math is correct. This review helps avoid errors that could lead to delays or issues with the IRS.

- After confirming your entries, you can save changes, download, print, or share the completed Schedule F as needed.

Complete your tax documents online to ensure compliance and maximize your deductions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Schedule F income includes revenues generated from farming activities, such as the sale of crops, livestock, and other agricultural products. Furthermore, any other income associated with these activities that aligns with IRS guidelines can be included. To ensure comprehensive understanding and compliance, review the IRS 1040 Schedule F Instructions meticulously.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.