Loading

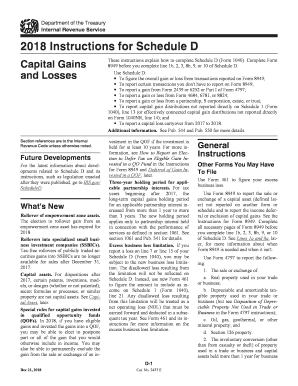

Get Irs 1040 Schedule D Instructions 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS 1040 Schedule D Instructions online

Filling out the IRS Schedule D can be a straightforward process with the right guidance. This guide provides user-friendly instructions on how to complete the IRS 1040 Schedule D instructions online, ensuring you navigate the form with ease and accuracy.

Follow the steps to successfully fill out the IRS Schedule D online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start with Part I, where you will report your short-term capital gains and losses. Make sure to complete Form 8949 before entering amounts on Schedule D. List each transaction, including the details of sales or exchanges you processed during the tax year.

- Move to Part II for long-term capital gains and losses. Here, again, you will need to reference Form 8949 to determine which transactions qualify as long-term and ensure your entries reflect this categorization.

- If applicable, in lines 1a and 8a, report the aggregate totals from transactions you do not report on Form 8949. Ensure that these totals reflect only transactions where you received a Form 1099-B indicating the basis has been reported to the IRS.

- For lines 11 through 18, report capital gains distributions and complete the required worksheets for collectibles gains and unrecaptured Section 1250 gains, according to the specifics of the gains and losses you reported in previous parts.

- Conclude by thoroughly reviewing your entries. Save changes, download, print, or share the completed form as necessary with the relevant parties, ensuring you've retained a copy for your records.

Complete your documents online today and take the next step towards filing your taxes efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Sales reported on Schedule D include those of stocks, bonds, and other capital assets. Additionally, you should include gains or losses from inherited property or collectibles sold during the tax year. Keeping an organized record of these transactions will support your reporting process. For convenience, consider leveraging USLegalForms for detailed guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.