Loading

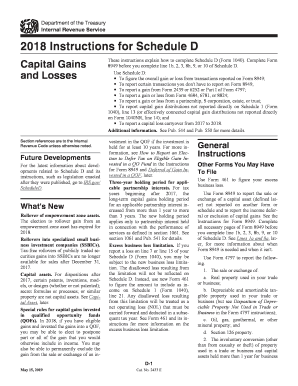

Get Irs 1040 Schedule D Instructions 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule D Instructions online

Filling out the IRS 1040 Schedule D can be a crucial task for reporting capital gains and losses from your investments. This guide provides clear, step-by-step instructions to help you complete the form online safely and efficiently.

Follow the steps to fill out the IRS 1040 Schedule D Instructions online.

- Press the ‘Get Form’ button to obtain the IRS 1040 Schedule D and open it in your editor.

- Begin by reviewing the instructions on the form for understanding the purpose and requirements of Schedule D. Familiarize yourself with terms like capital gains and losses.

- Complete Form 8949 before filling in specific lines on Schedule D. Ensure all necessary transactions are reported on Form 8949 as this will feed into your Schedule D total.

- Use the amounts calculated on Form 8949 to fill out the relevant sections of Schedule D. Focus on lines 1a through 10, noting which sections apply based on your transactions from Form 8949.

- If applicable, report any capital gain distributions received, found on Form 1099-DIV, on line 13 of Schedule D. Include information regarding any capital losses recognized.

- Refer to further specific instructions regarding unique situations like wash sales, partnership interests, or QSB stock exclusions, and complete additional lines (18, 19) as necessary.

- Double-check all entries for accuracy, ensuring that you've adhered to the instructions throughout.

- Once complete, save your changes. You may have the option to download, print, or share the completed Schedule D as needed.

Start competing your IRS documents online to simplify your tax filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Certain individuals may be exempt from filing Schedule D if they do not have any capital gains or losses to report. Additionally, if you only have gains from qualified retirement accounts or certain tax-exempt transactions, you might not need to file. Always check the IRS 1040 Schedule D Instructions to confirm your obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.