Get Irs 1040 Lines 16a And 16b 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Lines 16a and 16b online

Filling out the IRS 1040 Lines 16a and 16b accurately is essential for reporting your pension and annuity income. This guide will walk you through each step to ensure you complete these sections correctly while filing online.

Follow the steps to complete Lines 16a and 16b effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the total pension or annuity payments from Form 1099-R, box 1 on Line 16a. Ensure this amount is accurately reflected to report all income received.

- Calculate the taxable amount for Line 16b by subtracting line 8 from line 1. The result must be at least zero. If your Form 1099-R shows a larger amount, use the amount you calculated instead.

- If you were a retired public safety officer, review the guidelines related to insurance premiums before finalizing the amount for Line 16b.

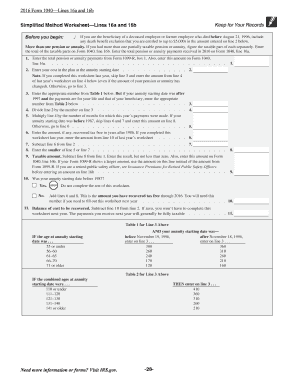

- Complete the Simplified Method Worksheet to determine the appropriate values for Line 16b if necessary. Enter your cost in the plan at the annuity starting date on line 2 of the worksheet.

- Use Table 1 or Table 2 provided in the worksheet based on your age at the annuity starting date to find the correct number. Enter this into line 3 of the worksheet.

- Divide the number entered in line 2 by the number obtained in line 3 and place this result on line 4 of the worksheet.

- Multiply the result from line 4 by the number of months for which this year's payments were made. If your annuity starting date was before 1987, enter this amount on line 8.

- Complete any additional calculations as directed in the worksheet until you finalize the values necessary for Lines 16a and 16b.

- Upon finishing the necessary calculations, review the entries made on Lines 16a and 16b for accuracy before continuing to save changes, download, print, or share the form.

Start filling out your IRS 1040 Lines 16a and 16b online today for a smooth tax filing experience.

Get form

Related links form

On 1040 TurboTax, line 16 typically represents a crucial figure in your total tax calculation. This number reflects your tax liabilities, considering the adjustments made throughout your tax return process. As you navigate through your return, understanding how IRS 1040 Lines 16a and 16b impact this figure is essential for accurate reporting. If you encounter difficulties, US Legal Forms is available to help clarify your situation.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.