Get Irs 1040 - Schedule F 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule F online

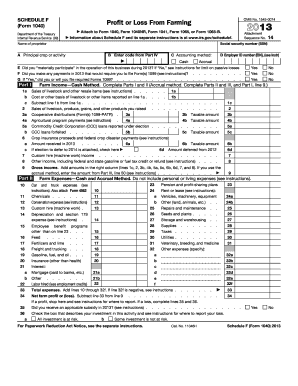

This guide provides a comprehensive overview of how to complete the IRS 1040 - Schedule F form online. It is designed to assist users with varying levels of experience in filling out this important tax document for reporting profits or losses from farming activities.

Follow the steps to accurately complete the IRS 1040 - Schedule F online.

- Press the ‘Get Form’ button to access the IRS 1040 - Schedule F form, which will open in your digital document editor.

- Begin by entering your name and Social Security number (SSN) in the designated fields at the top of the form.

- In Part A, indicate your principal crop or farming activity by selecting the appropriate code from Part IV provided in the form.

- Choose your accounting method—either Cash or Accrual—by marking the corresponding box.

- If applicable, enter your Employer Identification Number (EIN) instead of your SSN for business-related entries.

- Respond to the question about whether you materially participated in the farming operation, as this impacts passive loss limitations.

- Complete Part I by providing details about your sales of livestock and other products raised, including cooperative distributions and agricultural program payments.

- In Part II, document all applicable expenses that relate to your farming operation, ensuring you capture all itemized deductions such as feed, utilities, and repairs.

- Calculate your total farm income by adding the relevant amounts and transferring the result to the appropriate lines.

- If you have incurred a loss during the year, follow the instructions to understand where to report this information on your tax return.

- After filling out the form, review all entries for accuracy, then save your changes or download the document for your records.

- Finally, print or share the completed form as required to ensure timely submission.

Start completing your IRS 1040 - Schedule F online today for accurate reporting of your farming income.

Get form

Related links form

Individuals who are at risk for IRS 1040 - Schedule F typically include those with substantial investments in farming activities and a significant amount of income from these operations. Risk may also be associated with unreported income or discrepancies in expense claims. It's crucial to maintain accurate records and seek professional advice to minimize the risk of audits. Platforms like uslegalforms can help you navigate these complexities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.