Get Irs 1040 - Schedule Eic 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule EIC online

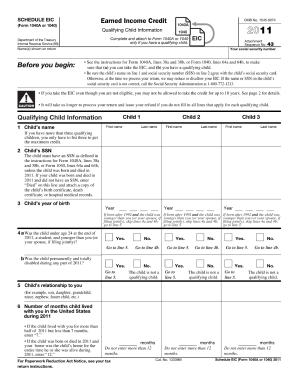

Filling out the IRS 1040 - Schedule EIC can seem daunting, but with the right guidance, you can complete it with confidence. This form helps eligible users claim the Earned Income Credit, which can provide valuable financial support.

Follow the steps to successfully complete your Schedule EIC online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by reviewing the eligibility criteria for the Earned Income Credit listed on the form. Ensure that you meet all requirements before proceeding.

- Fill in your personal information, including your name, Social Security number, and address. Ensure that all details are accurate.

- Indicate your filing status as it pertains to the primary form. This information is crucial for determining your eligibility and credit amount.

- In the sections provided, report your earned income and any qualifying children. Follow the instructions closely to ensure that you fill out these fields correctly.

- If applicable, provide information about any other qualifying individuals who may help in determining your credit eligibility.

- Review the form for accuracy, confirming that all information is correctly entered. Double-check calculations where required.

- Once you are satisfied with your form, you can save your changes, download it, print it, or share it as necessary.

Start completing your IRS 1040 - Schedule EIC online today for a smoother filing experience.

Get form

Related links form

The primary rule for EIC is that it is designed for low to moderate-income earners, and eligibility depends on income limits and the number of qualifying children. To qualify, your invested income and earned income must fall under specific thresholds outlined by the IRS. If you do not have qualifying children, you may still qualify based on your income. Knowing these rules can ensure you take full advantage of the IRS 1040 - Schedule EIC.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.