Loading

Get Irs 1040 - Schedule Eic 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule EIC online

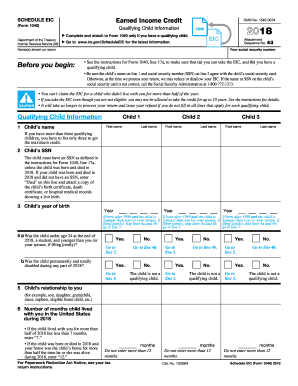

The IRS 1040 - Schedule EIC is an essential form for individuals who qualify for the Earned Income Credit through their dependents. This guide provides a step-by-step approach to completing this form online, ensuring a smooth filing process.

Follow the steps to successfully complete Schedule EIC online.

- Click ‘Get Form’ button to acquire the IRS 1040 - Schedule EIC form and open it in the online editor.

- Begin by entering your Social Security number and the name(s) shown on your tax return at the top of the form.

- In the 'Qualifying Child Information' section, provide the necessary details for each qualifying child. Start with entering the child's name in the designated fields.

- Enter the child's Social Security number in the appropriate field. Ensure that this matches the information on the child's Social Security card.

- Provide the year of birth for each child. Please ensure accuracy as this information determines eligibility.

- Answer the questions regarding the child's educational status and age at the end of the tax year. Provide details if the child was a full-time student or permanently disabled.

- Indicate the relationship of the child to you, such as son, daughter, or grandchild, and how many months the child lived with you during the year.

- Review all entered information for accuracy before proceeding. It is crucial to ensure all details are correct to avoid delays in processing.

- Once you have completed all sections of the form, save your changes, and download or print the completed form for your records. Make sure to attach it to your IRS 1040 return, if required.

Complete your IRS 1040 - Schedule EIC online today to ensure you receive the credit you are entitled to.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can locate your earned income on Form 1040 by reviewing your W-2s or 1099s for total salaries or wages. It is essential to gather all income statements to ensure accuracy when filling out your IRS 1040 - Schedule EIC. If you need further assistance, consider visiting US Legal Forms for guidance and templates.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.